Detroit OEMs Embrace ‘Alternative Work Schedules’ to UAW’s Consternation

As the U.S. light-vehicle SAAR approaches 15 million, the auto makers will be challenged to meet demand without investing in new plants.

LIVONIA, MI – Expect Detroit auto makers to leverage contentious “Alternative Work Schedules” as a hedge against costly capacity expansion, a noted labor expert says.

Kristin Dziczek, director-labor and industry group at the Michigan-based Center for Automotive Research, says General Motors, Ford and Chrysler have sufficient capacity to serve current U.S. market conditions.

The seasonally adjusted annual rate for light-vehicle sales is hovering near 13.21 million units, according to WardsAuto data. But as this total approaches 15 million, as projected for the 2014-2015 timeframe, the Detroit Three will be challenged to meet demand. Enter AWS.

Deviating from the standard 5-day workweek delivers significant benefits to auto makers seeking to increase output without investing in plant expansions or all-new production sites. But such performance comes with a personal cost borne by workers who often are compelled to work weekends.

“They hate it,” Dziczek says. “I’m a single mom. I couldn’t work like that.”

Chrysler is at the forefront of the trend. The auto maker squeezes 49 additional days of production per year from a 3-crew, 2-shift schedule at its engine plant in Trenton, MI, home to the acclaimed Pentastar V-6.

A similar schedule is in place at Chrysler’s engine plant in Dundee, MI, sole source of the 4-cyl. World Engine and lone North American site of Fiat FIRE engine output.

Implementation of AWS at those plants was so contentious that it nearly derailed the recently concluded contract talks. But the benefits derived by Chrysler are irresistible.

“They get around capacity and they get around the overtime issue, too,” Dziczek tells WardsAuto on the sidelines of today’s event.

Assembly-plant capacity utilization rates among the Detroit Three suggest more pressure is being brought to bear on workers. The auto makers should see utilization hit 75% next year and approach 80% by the end of 2013, up from the current 69%, according to WardsAuto data.

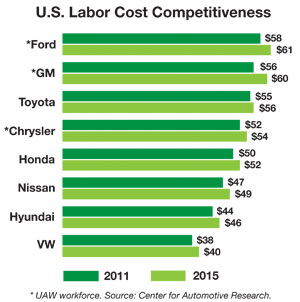

Against this backdrop, Arthur Schwartz, president-Labor and Economics Associates and former lead negotiator for GM, reveals Detroit auto makers have closed the labor-cost gap on their Asia-based rivals that operate plants in the U.S.

Ford leads the pack with a total labor cost of $58 per hour, including obligations to retirees. But that is a significant improvement from the $78 range Detroit auto makers paid in 2007.

By 2015, when the new UAW deal expires, Ford’s all-in labor cost will be $61 per hour. But all other auto makers also will see increases.

Chrysler’s labor costs trail those of Toyota’s, long regarded as the industry’s benchmark.

But wages likely will be at the forefront of 2015 negotiations. Cost-of-living allowances, which are suspended under the current deal, “will be an issue,” Schwartz warns, adding UAW members have not enjoyed a raise in 14 years.

Retirees, too, will want a benefit increase. The latest round of talks marked the first time since 1950 that a UAW contract did not include a bump for retirees, Schwartz says.

About the Author(s)

You May Also Like

_(2).jpg?width=700&auto=webp&quality=80&disable=upscale)