Wards Intelligence updates its SDV Scorecard, which evaluates and ranks automakers based on their progress towards Software-Defined Vehicles in five revised categories: financial strength, portfolio complexity, vehicle platform readiness, organizational readiness and SDV business performance.

This year’s scorecard now includes a global market reach, including Chinese OEMs, and utilizes 18 metrics, incorporating SDV market share, the highest SDV level achieved in production and electrical/electronic architecture consolidation index. The scorecard is based on 2024 global data, including vehicle sales forecasts and the most recently available financial information.

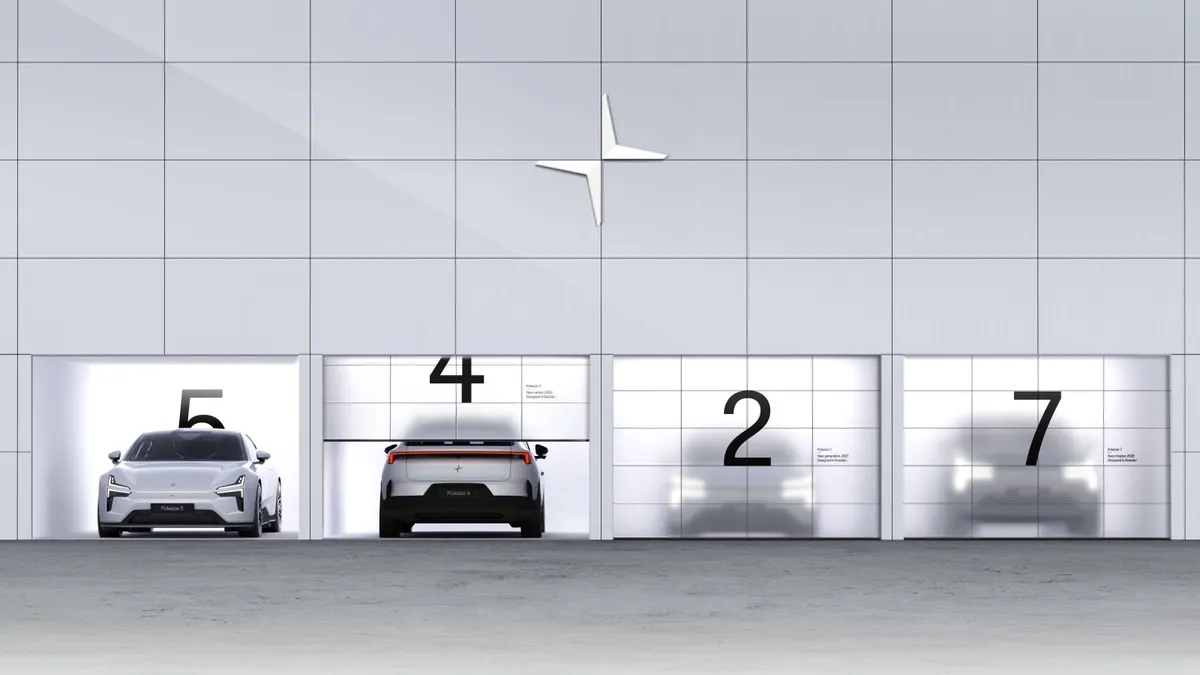

Wards Intelligence compares 27 automakers based on their performance within all ranking categories through a set of quadrants to identify their distinct evolution path in organizational and financial readiness, how financial strength and portfolio complexity affect their evolution and which OEMs are ideal acquisition targets, as well as what OEMs should be looking into acquisitions to speed their advancements.

This year’s Leaders category features OEMs pushing the SDV boundaries and building platforms for innovation alongside those deploying zonal architectures and refined state-of-the-art SDV technology. This space remains largely dominated by battery-electric-vehicle disruptors that are digitally native, prioritize a software-first approach and benefit from not having to manage legacy platforms and systems.

In last year’s evaluation, Tesla was the only company to achieve both scale and financial stability and this remains true today. Except for the experimental Cybertruck, Tesla’s vehicles maintain unmatched stability and technological maturity combined with strong business performance.

However, Tesla faces the challenge of maintaining its market leadership. While most traditional automakers are still consolidating their E/E architectures, the gap with other disruptors is narrowing. Tesla has already lost its position as a disruptive innovator to NIO and Xiaomi and is struggling to meet goals in China despite price cuts.

Xiaomi enters the leader category this year with its SU7, carving out a new segment of SDVs that are multisensory and deeply integrated with edge devices and Internet of Things ecosystems. The only other competitor in this space among SDV Leaders is NIO.

NIO and Xiaomi have yet to achieve technological stability, maturity and profitability. However, NIO is getting closer to breaking even and Xiaomi leverages its operational and financial strength in adjacent markets, particularly its smartphone business, to bolster its SDV offerings.

Xpeng also debuts in the Leaders category. The OEM is deploying a modular E/E architecture based on centralized computing, is at the forefront of integrating AI into mobility and is known for its frequent over-the-air updates in China. Its collaboration with Volkswagen, even though based on an older platform, provides validation and monetary support for this promising player.

Rivian has maintained its position among the Leaders, largely thanks to its recent transition into zonal architecture. VW’s collaboration, potentially involving a $5 billion investment, provides Rivian with a much-needed financial lifeline while opening the door to a lucrative software licensing model – a strategy pursued by Lucid and Tesla without significant success so far.

Tesla’s rivals are still grappling with profitability and product refinement. But it is worth remembering that it took Tesla years to refine its technology and 17 years to become profitable. Furthermore, the company’s lack of significant model redesigns, focus on projects such as the Cybertruck and the Roadster and the controversies surrounding its CEO all contribute to shrinking its competitive gap.

The Strong Contenders category, which last year primarily featured OEMs deploying semi-SDVs without fully commercializing the technology, has undergone a significant shift. Now 67% of the automakers in this category are actively commercializing SDVs, underscoring the rapid growth and rising competitiveness of the SDV market.

Notably, 64% of the automakers across both the Leaders and Strong Contenders categories are of Chinese origin or ownership, highlighting China’s dominance in the SDV space.

The comparison of automakers’ organizational and vehicle platform readiness yields some interesting insights. The data indicates a strong positive relationship between the two, suggesting that improvements in one area tend to drive advancements in the other.

It’s worth noting that no OEMs have ranked high in organizational readiness while scoring low in vehicle platform readiness. This implies that vehicle platform improvements are generally prioritized, possibly because they are considered a prerequisite for organizational changes or because organizational transformations are inherently more complex.

Conway’s Law states that organizations that design systems are constrained to produce designs that mirror their internal communication structures. Notably, in the case of SDVs, this relationship appears to be bidirectional – new vehicle architecture designs are reshaping legacy organizational structures, creating a two-way feedback loop between technology development and organizational adaptation.

In terms of performance, disruptors and Chinese OEMs outperform legacy automakers in vehicle platform readiness, organizational readiness and overall SDV business performance. On the other hand, Japanese OEMs continue to lag behind in all criteria, resulting in the weakest SDV business performance in the analyzed sample. However, this situation might change with the recently announced Japanese government-led initiative which aims for Japanese automakers to capture a 30% share of the global SDV market between 2030 and 2035.