A WardsAuto forecast calls for U.S. automakers to deliver 1.48 million light vehicles this month.

The forecasted daily sales rate of 59,309 over 25 days represents a modest 0.6% improvement from like-2014 (24 days), with total volume for the month rising 4.8%.

At forecasted levels, June will be the 16th consecutive month to outpace prior-year comparisons.

The forecast 5.2% DSR decline from May (26 days) is in line with the 7-year average change for May-June.

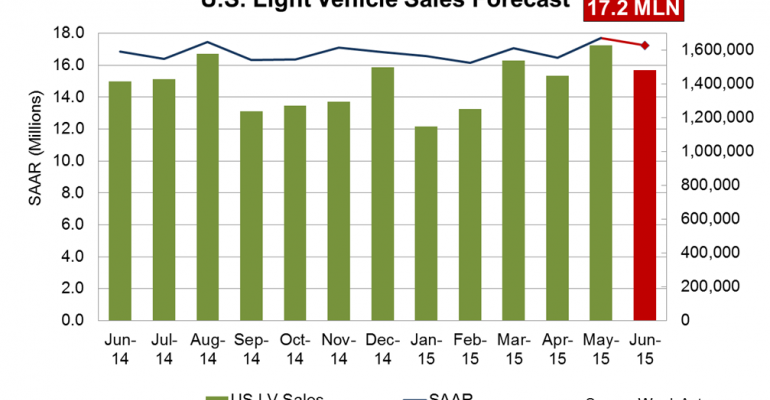

The report puts the seasonally adjusted annual rate of sales for the month at 17.2 million units, shy of last month’s 17.7 million SAAR, but ahead of the current 3-month SAAR (17.1 million) and the year-to-date SAAR through May (16.8 million).

The forecast reflects reports of very strong retail activity for most automakers continuing from May offset somewhat by a downturn in sales to fleets.

Inventory is expected to rise from 3.51 million units at the end of May to 3.57 million units at the end of June, leaving automakers with a healthy 60 days’ supply at forecast sales rates, up from May’s 56 days and year-ago’s 59.

General Motors daily sales are forecast to decline 3.5% from year-ago, due largely to lower fleet sales, with total deliveries for the month of just under 269,000 cars and light trucks this equating to an 18.1% share of LV sales, compared with 18.9% last year.

Ford’s DSR is expected to fall 3.2%, with strong fleet sales expected compared with year-ago but overall volume capped by weak retail sales this month. Ford’s volume sales should come in just ahead of year-ago, at just below 220,000 units, claiming 14.8% of LV sales, down from year-ago’s 15.4% share. Ford was less active in incentives in June, and short inventory of its new F-Series pickup continues to provide additional market space for GM and Fiat Chrysler US in the segment.

Steady retail sales and a significant year-over-year decline in fleet deliveries will cut into Toyota’s June share, as the automaker’s DSR is expected fall 4.1% on near-identical volume as year-ago, equating to a 13.6% share.

WardsAuto is forecasting FCA sales near 184,000 LVs, lifting daily sales 3.6% over year-ago and giving the automaker a 12.4% share compared with a 12% take for same-month 2014.

Nissan is expected to finish the month in a dead heat with rival Hyundai Group, with each automaker forecast to deliver 123,000 LVs while accounting for 8.3% of monthly sales apiece. The Hyundai Group forecast reflects expectations that Hyundai-brand DSR will fall 12.3% from year-ago while Kia daily sales rise as much 14.6%.

Honda DSR should climb 3.5% from year-ago on volume sales of just under 140,000 units, equating to a 9.4% market share versus last year’s 9.1%.

Subaru should claim a 3.1% market share on a 7.3% DSR gain, resulting in just over 46,000 deliveries.

Projected June LV sales would bring year-to-date deliveries to 8.5 million units, a 4.6% improvement from same-period 2014. WardsAuto currently is forecasting 16.94 million LV deliveries for calendar 2015.