Bloomberg New Energy Finance CEO Jon Moore offers a bullish outlook for electric vehicles at BNEF’s recent San Francisco summit.

Highlights of Moore’s talk:

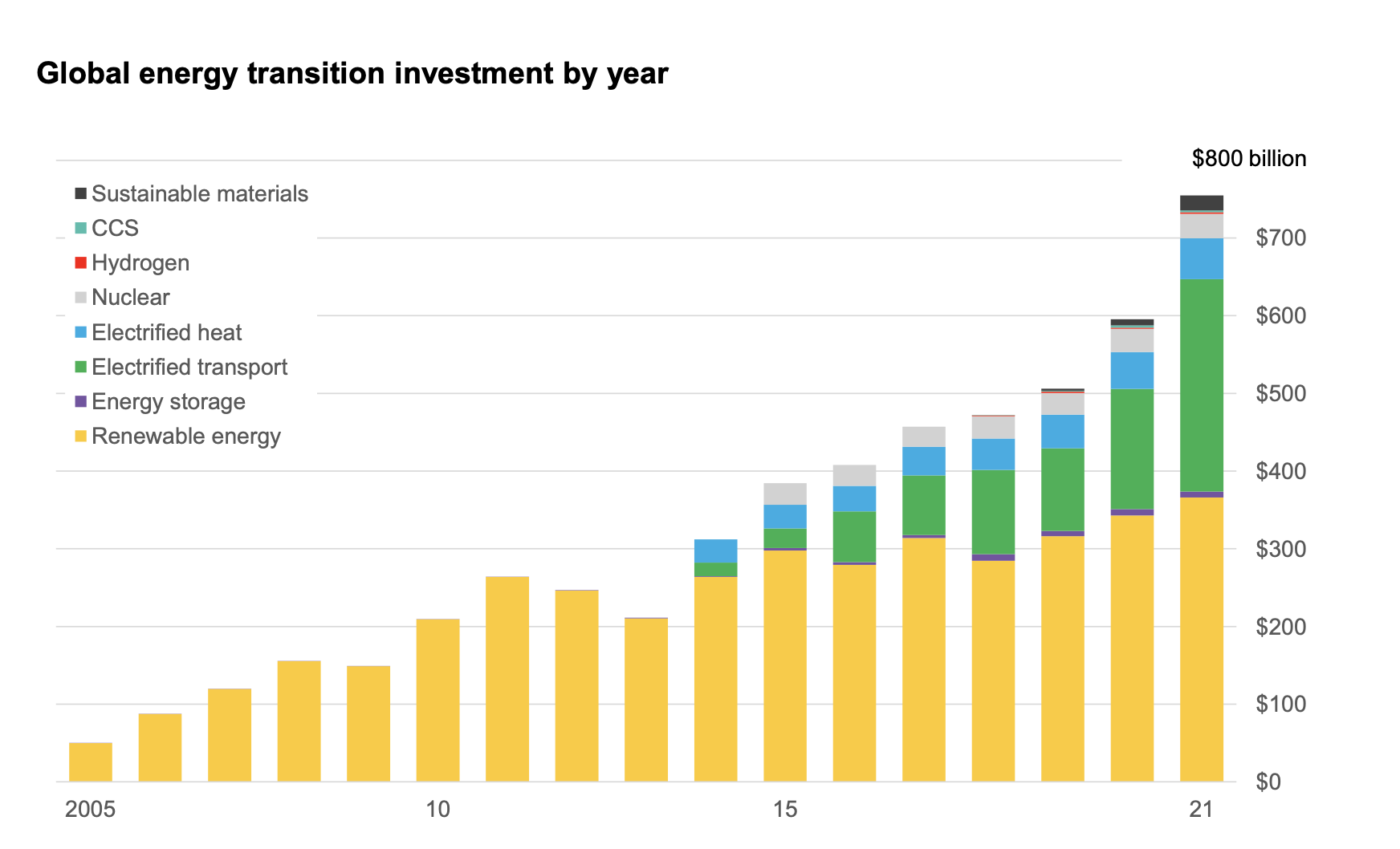

- Renewable energy and electrified transport investment topped $360 billion and $270 billion, respectively, in 2021. The totals came to nearly 85% of investments in transitional (non-fossil) energies for the year, which in turn were up an estimated 25% over 2020 levels (see chart, below).

- Global sales of electrified vehicles more than doubled to 6.6 million units in 2021, up from 3.2 million in 2020. An estimated two-thirds of the total were battery-electric vehicles, the remainder plug-in hybrid vehicles.

- More than half of 2021 demand, 3.3 million units, was in China. New Energy Vehicles, Chinese terminology for BEVs and PHEVs, accounted for 15% of total passenger vehicle sales in the country.

- Globally, EVs accounted for 10% of new-car sales in third-quarter 2021, with Europe’s share reaching 17%.

- In 2022, BNEF projects EV sales will grow to 10.5 million units, of which 74% will be BEVs. By market, 54% of sales are projected to be in China, 30% in Europe and 12% in North America.

Moore (pictured, below left) reports that in 2021, China sold more EVs than the rest of the world did in 2020. “If you look at China since the beginning of the pandemic,” he notes, “(BEVs have) gone from literally 4% or 5% of the (Chinese) market to 20% by the end of last year.”

Discussing market capitalization, the BNEF executive says: “Market cap of global automakers has grown from about $1 trillion (in 2019) to nearly $3 trillion last year. There may well be a bit of a bubble and the totals may come back down, but the trend is pretty clear.”

Discussing market capitalization, the BNEF executive says: “Market cap of global automakers has grown from about $1 trillion (in 2019) to nearly $3 trillion last year. There may well be a bit of a bubble and the totals may come back down, but the trend is pretty clear.”

The market believes new investment in traditional vehicles will continue, but even more spending will be focused on on BEVs. “So, the market is betting that pure-play EVs and electrification (are) really going to be the main driver of growth.”

Turning to Tesla, the world’s No.1 BEV maker, Moore says: “Tesla’s market capitalization was about $1 trillion. It's now down to $932 billion. So, from a market perspective, Tesla is a driver. But what is interesting is the smooth growth curve of annual sales. Tesla (has) built out a real company that makes a lot of vehicles.”

Tesla sold 936,200 vehicles in 2021, up from 499,600 the year before, he says.

But even traditional combustion-engine players are making inroads into the EV market. Porsche’s Taycan BEV, according to Moore, is now its third best-selling car, with sales last year of 41,295 units, ahead of the 911 and Panamera.

Reflecting the push toward improving BEV technology, Moore reports range now averages nearly 250 miles (400 km), up from slightly more 62 miles (100 km) 10 years ago.

Meanwhile, 58% of global OEMs have set “net zero” emissions targets by 2050, up from 45% in 2020 and 10% in 2018.

On a country basis, 34% of emissions were covered by some form of net-zero goal at the beginning of the pandemic. That’s now 89%, he says.

Putting this on a timeline, Moore says that, excluding Norway as an outlier, the industry is starting to see big markets – including the U.K., the Netherlands and Canada, as well as New York and California – planning to ban ICE vehicles by 2035. Austria and Israel have targeted 2030, he says.

“It’s starting to be real,” Moore says. “And if you add all of these bans, it’s about just over 20% (global market penetration of EVs). So, actually the manufacturers are more than twice as bullish about net zero as government legislators are. Is there a real, clear path ahead? I think there is. There’s a really clear path towards de-carbonization. Will there be short-term volatility to cope with? There will be. But now it’s about us accelerating down that road.”

Looking at the energy picture, Moore reports both natural gas and oil prices are in flux.

“Gas has really spiked in the last few months because the market is very tight,” he says. “We started with very low storage volumes. The flows in from Russia have been down from historic levels, while the competition for gas in Asia and the Pacific has been very high. That makes for a very tight market and very volatile.

“In the case of oil, there have been high demand and supply constraints.”