MUMBAI – Tata Motors new CEO, Guenter Butschek, is moving quickly to turn around the automaker, which has been on a sharp downslide from the performance and profit peaks of just three years ago.

On the job four months, Butschek already has woven Tata’s old HorizoNext program into a revised 3-year 2019 Plan for a revival that calls for new mobility concepts and advanced powertrains.

He is pushing for higher quality, demanding plants build vehicles right the first time and emphasizing to employees that Tata’s profitability depends on product quality.

Butschek’s plan calls for new, more contemporary vehicles with improved performance to meet the needs of a new generation of customers and restore prestige to the Tata brand.

Targeted is a recovery of lost market share, chiefly by removing production bottlenecks, refining operations and rolling out new models.

Leading the product-development charge is Tim Leverton, president-Engineering Div., who is at work on new-generation platforms and vehicles with higher quality and reliability and lower production costs.

Previously, Tata designed components and vehicles first, then tried to figure out how to make them, Leverton says. That led to poor quality, launch delays and higher costs. The process has been replaced with common global practices that have design, engineering and manufacturing teams working together from the start.

Butschek’s marketing team, led by Mayank Pareek, president-Passenger Vehicles Div., also is ready to help transform the automaker. Pareek came to Tata 18 months ago, after 15 years with Maruti Suzuki.

However, sales of the brand’s two newest vehicles, the Bolt hatchback and Zest compact sedan, got off to a slow start, declining 21%-23% in their first six months on the market through March. It is too early to judge their performance, but it shows Butschek and Pareek have a long way to go in reviving the brand.

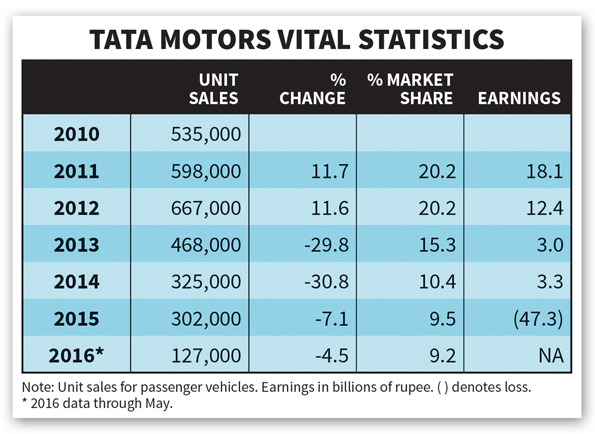

Tata Motors’ sales and market share peaked earlier in the decade. Sales reached 667,000 units in 2012, for a 20.2% market share. Profits topped Rs18 billion ($394 million) in the fiscal year ended March 2012.

That was the Tata Motors from which Ratan Tata retired after 50 years of service, including 21 years as company chairman. Before handing over the reins, he had transformed Tata with bold management and operational decisions that included large global acquisitions, most important of which was U.K. automaker Jaguar Land Rover. Presently, the bulk of Tata Motors’ profits are generated by JLR.

Following Ratan Tata’s exit, there was a new CEO nearly every year, with a 2-year period with no CEO at all following the death of Karl Slym in early 2014. Tata Chairman Cyrus Mistry filled the CEO spot on an interim basis until Butschek was named to the post in February.

Tata sales dived 54.7% to 302,000 in 2015 and market share was slashed in half to 9.5%, with the automaker reporting losses of Rs47.3 billion ($695 million) last year.

Part of Tata’s decline can be blamed on the overall weakness of the market, but some of the drop is attributed to the management shuffle and product competitiveness.

Tata’s plans call for two new vehicles every year through 2020. Some of them are nearing production, including the Kite 4 hatchback, Kite 5 sedan, Hexa CUV and Nexon small CUV.

Two new flexible, modular vehicle platforms that can maximize parts sharing and cut costs are in development with help from JLR. One, called Harrier, will underpin a new Safari SUV. A second, dubbed Raptor, will be used to spawn all of Tata’s future small cars.

But it will be some time before it’s clear whether Butschek’s 3-year crash program to right the ship will pay dividends.

Summing up, Tata Chairman Mistry says, “Tata Motors is at an inflexion point.”