ANN ARBOR, MI – Prepare for a powertrain technology onslaught, experts say, a regulatory fueled offensive seen as a boon to suppliers with the right parts and components and a challenge for automakers because many U.S. consumers are uneducated about the benefits of paying extra for higher fuel economy.

“People know about one-third of what these technologies can do,” says Bryan Krulikowski, vice president-Transportation and Technology at Morpace Market Research and Consulting.

Krulikowksi, whose group publishes an annual survey of consumer interest in powertrains, says a lack a buyer familiarity with fuel-saving technologies will be a major hurdle for automakers in the coming years. Fuel-economy regulations will continue to tighten and compel automakers to add expensive powertrain technologies to their cars and trucks, but buyers do not see the benefit, especially when gasoline prices remain a relatively cheap $3 per gallon.

“Conventional gasoline (engines) are what people are familiar with and it impacts how they feel about (advanced) technologies,” he tells a conference on 21st-century powertrain technologies at the University of Michigan Transportation Research Institute.

Krulikowski points to two areas where automakers fall down trying to educate consumers about technologies such as diesel, hybrid and plug-in hybrid electric vehicles. Marketing messages tend to be too focused, he offers, and dealership salespeople often lack knowledge and are typically pushed to sell products off the lot.

The knowledge gap already could be affecting sales of advanced-technology vehicles, which last year accounted for 3.5% of the nearly 17 million cars and trucks sold in the U.S., according to WardsAuto data.

“Part of the issue is the technologies are really focused, such as in zero-emissions vehicles states, but the other problem is price. How can you sell it?” he asks, citing the Chevrolet Volt extended-range electric vehicle from General Motors as one example of a technology difficult for consumers to get their arms around and, as a $35,000 compact car, a stretch for many pocketbooks.

GM sold 18,805 Volts last year after expecting upwards of 60,000 units annually when the car launched in 2010. Company executives have said explaining the technology to buyers has been more difficult than anticipated.

Tesla bucks the trend, Krulikowski says. The electric-vehicle maker markets its technology well, he claims, evidenced by buyers cross-shopping its six-figure EVs with mainstream vehicles with similar technologies. It helps, he admits, that Tesla wraps its technology in a highly attractive package.

For mainstream automakers, the battle to educate buyers will be on the dealership floor. “That’s going to be the driver of these technologies,” Krulikowski tells WardsAuto.

But dealership employees already are pulled in many different directions and asked to perform a wide variety of selling tasks, adds Bruce Belzowski, managing director-Automotive Futures at UMTRI. Plus, sales people are pressured to sell what’s in inventory and usually that does not include an alternative-propulsion vehicle.

“It’s a real struggle if your dealer body is not educated,” Belzowski says.

Mind the Gap

But the knowledge gap must close, experts say, because CAFE regulations call for automaker fleets to achieve a proposed 54.5 mpg (4.3 L/100 km) in 2025, up from 35.5 mpg (6.6 L/100 km) in 2016. Those strict rules will force automakers to add powertrain technologies whether or not consumers are ready, and it is unlikely the federal government’s midterm review of the 54.5 mpg rule in 2017 will take into consideration the current market dynamic of low fuel prices and stagnant alternative-propulsion vehicle sales.

“We’re not expecting low fuel prices to be in place for the next 10 years,” says Therese Langer, program director-American Council for an Energy-Efficient Economy, a group that works closely with the EPA and NHTSA on rulemaking. “And one of the main reasons for the tougher CAFE rules at this time is to encourage progress on alternative technology through this low-gas-price period.”

As much of a challenge as the next 10 years will be for automakers, it is a tremendous opportunity for suppliers.

“If suppliers can deliver fuel-saving solutions, and many of them are very small things that taken together add up to a lot, you’re really talking about something,” says Jeff Jowett, manager-North and South America Powertrain Forecasting at IHS.

The Center for Automotive Research in Ann Arbor has estimated automakers will spend $150 billion to meet the 2025 standards, or roughly three times as much as it will take to achieve the 2016 bogey.

“It’s a good time to be a supplier,” Jowett says, but adds it is an equally challenging time. “You have to have the right technologies. They will have to bring their A-game.”

There will be lots of technologies for suppliers to pursue, too.

Experts think downsized, turbocharged gasoline engines with direct injection, such as the EcoBoost technology at Ford, will be the dominant architecture heading to 2025. On top of that, they say, automakers will continue to add automatic-transmission technologies with gear ratios higher than eight speeds. CVTs will see some modest growth, but the fuel-saving dual-clutch automatics so popular in Europe will continue to fizzle in the U.S.

“They just drive differently.” Jowett says of DCTs, which shift more abruptly than traditional automatics and lack the slow-speed creep of their counterparts. “People are just not aware of what to expect. Consumers like creamy shifts.”

John Shutty, chief engineer-Advanced Controls and Simulation at supplier BorgWarner, admits there are many unknowns on the road to 54.5 mpg, especially when most forecasts for the penetration rates of PHEVs and BEVs remain conservative and the internal-combustion engine is expected to retain its leadership.

“No vehicle sold in 2014, other than an EV or a hybrid, would meet 2025 rules,” he says. “That means somehow these vehicles from 2014 must change. That’s a big question for us. How do we support those changes?”

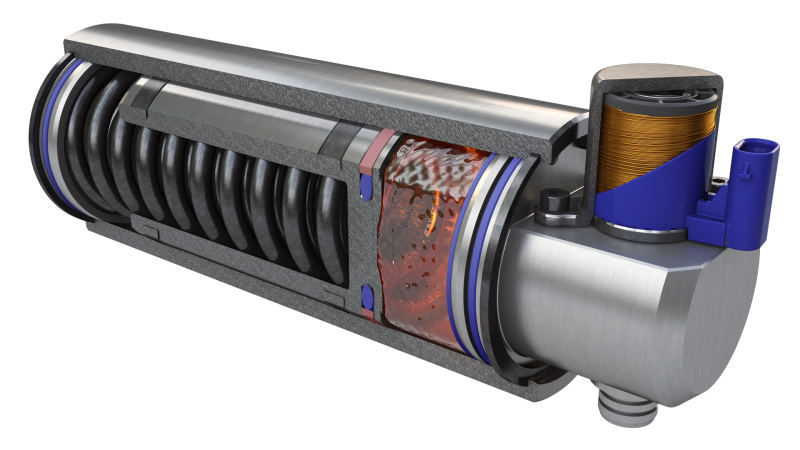

Shutty offers a long list of technologies eyed by BorgWarner and its competitors, including next-generation exhaust-gas recirculation for diesel and gasoline engines to trim carbon-dioxide emissions; broader use of variable cam-phasing technology; electrification through stop-start systems, but also for key pumping components and to accommodate so-called sailing, where engines shut down at highway speeds when power demands are low.

Look for 48V electrical systems to join existing 12V systems to help power bigger vehicle components, such as superchargers and turbochargers, he adds.

Shutty also sees emerging soon advanced thermal-management techniques, such as split cooling and the use of coolant control valves to regulate temperatures of multiple components, sparkless gasoline combustion, higher-pressure turbocharging, electrified drivetrains and broader use of alternative Miller and Atkinson cycles.

It adds up to what Shutty calls the second-generation downsizing, or a small-displacement engine with turbocharging and GDI layered with incremental fuel-saving technologies.

“The next 10 years are going to be very exciting,” he says.