NEW YORK – Porsche Cars North America Inc. will close 2006 with a new sales record, says President and CEO Peter Schwarzenbauer.

But next year appears less certain.

The 2006 performance – sales totaled 31,377 through November, up 7.9% from year-ago’s pace – comes on top of record sales in 2005, when a total of 31,933 cars and trucks were sold in the U.S.

But Porsche is tugging on the reins as it heads into next year, scaling back on a spring inventory buildup by 17% from 2006 levels.

“I’m uncertain about 2007,” Schwarzenbauer says. “I don’t know what the economy will do.”

The real-estate slump worries him, outweighing, in his mind, the positive effects of a hot stock market. “If January and February are more positive, our factories can ramp up production in three or four months and increase supplies for the hot selling summer season,” he says.

“We are prepared for most external conditions. We can make money even in the worst scenario.”

This has been a tough year for the U.S. auto industry in general, Schwarzenbauer concedes. “It makes us feel extremely good about how we’re performing in this market.”

Competitors, he notes, reacted to the tough climate with more incentives.

“We’re not playing the incentives game,” he says. “If incentives get worse it will be devastating.”

Without any incentives, the 911 recorded its best November, with sales up 19.1% above 2005.

“We would rather reduce production than give incentives,” Schwarzenbauer says. “We don’t see the need for reacting with incentives.”

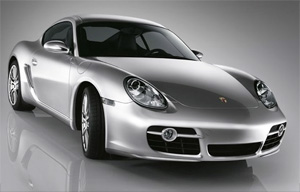

Avoiding spiffs helps boost residual values, he says, noting the 3-year residual on the 911 is 62%. The Cayman and Boxster have 3-year residuals of 56% and the Cayenne is running at 58%.

The 911 will post record sales this year, Schwarzenbauer says, with 60% of the models sold high-end cars. About 45% of 911s are purchased with all-wheel drive. Sales of coupes and cabriolets are split about 50/50.

The new Cayman coupe has cannibalized only 3% of 911 sales, the PCNA executive says. “The total is a little higher with Boxster,” he says.

In addition, he says 911 demand is growing despite a decline in luxury roadster sales from the 2000 peak of 75,000 units. This year the sector should account for about 50,000 vehicles, he says.

Porsche has enjoyed a 17% average annual growth rate for the last decade, Schwarzenbauer says. “This puts our dealer body on a more solid basis.”

Adding the controversial Cayenne cross/utility vehicle to the Porsche portfolio has improved company profits, he says. Since its introduction four years ago, Cayenne sales have averaged 15,000 units annually.

“Our target was 10,000-12,000 per year,” Schwarzenbauer says. “From our point of view the Cayenne is extremely successful.”

Despite the success of Porsche’s collaboration with Volkswagen AG to build the Cayenne, Schwarzenbauer does not envision future vehicle joint ventures. However, there may be some cooperation on components, he speculates.

About 70% of Cayenne buyers are new to Porsche. But the loyalty rate for the vehicle is only 30%.

“That’s less than we experience with the sports car,” Schwarzenbauer says.

The second-generation Cayenne will debut at the North American International Auto Show in January. It will go on sale in March as an ’08 model. There will be no ’07 Cayenne.

Commenting on the fact that more companies are introducing sports cars, Schwarzenbauer says he sees this as a positive trend.

“It helps us get the message out that sports cars are fun,” he says. “We see this as an opportunity for us.”