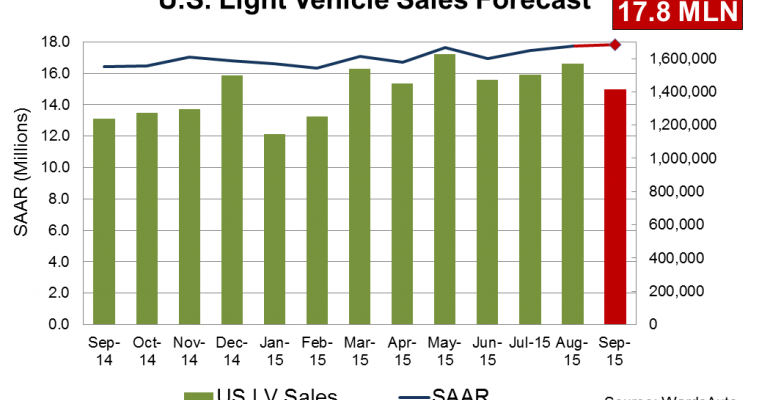

A WardsAuto forecast calls for U.S. automakers to deliver 1.42 million light vehicles in September, an 11-year high for the month.

The report puts the seasonally adjusted annual rate of sales for the month at 17.8 million units, slightly above last month’s 17.7 million SAAR and well ahead of the year-to-date SAAR through August (17.1 million).

The forecasted daily sales rate of 56,647 over 25 days marks a 9.8% improvement from like-2014 (24 days), resulting in the greatest year-over-year growth in 25 months. The 6.2% DSR decline from August (26 days) is better than the 3-year average August-September change, -7%.

The monthly volume will be 14.3% above last year. Beyond an extra selling day, there were more sales incentives this September, because the calendar set most of the Labor Day weekend discounts in August last year.

The forecast also reflects improvements in the Conference Board’s Consumer Confidence Index, added jobs and declining unemployment rate in the previous month.

The bulk of the September sales surge comes from light trucks, as daily sales of the vehicle type are expected to grow 16.7% from last year. The DSR for cars is expected to rise only 0.1%

WardsAuto is forecasting General Motors will account for 17.2% of September LV sales, down from 18% year-ago. The DSR is expected to improve 4.8%. The 244,000 forecasted deliveries would bring GM’s year-to-date total to 2.29 million, up 3.8% from same-period 2014.

The report calls for Ford to sell 215,000 LVs for a 15.2% market share and 18.0% DSR jump. The automaker is expected to finish the month with January-September sales of 1.93 million, up 4.8%.

FCA is projected to grab 13.7% of deliveries, with just under 194,000 units. The 10.7% increase in daily sales will boost the company into third place for the month. September sales will bring FCA’s 9-month total deliveries to 1.65 million, 6.4% above same-period year-ago.

Toyota’s daily sales should rise 14.3% for 191,000 total units. The resulting 13.5% share, equal to year-ago, puts the automaker in fourth place, ending an 11-month streak in the No. 3 spot. The automaker will hold its third-place position year-to-date, with a 1,864,273 total that is 3.9% better than like-2014.

Honda’s DSR is expected to rise 5.3% leading to 130,000 deliveries and giving the company a 9.2% share. Honda shows the lowest January-September improvement of the top seven automakers, growing just 2.1% to 1.18 million.

The WardsAuto forecast also calls for Nissan to narrowly outpace Hyundai-Kia for the fifth consecutive month with 117,000 versus 115,000 units. Nissan’s 9-month total is 5.1% above year-ago, and Hyundai Group’s figure sits 5.3% higher than like-2014.

Projected September LV sales would bring year-to-date sales to just under 13 million units, a 4.9% improvement from same-period 2014 and a 10-year high for the period.

Inventory is expected to rise from 3.30 million units at the end of August to 3.34 million units at the end of September, leaving automakers with a 59 days’ supply at forecast sales rates, up from August’s 55 days but below year-ago’s 64.