Ford of Europe says its Q1 vehicle-sales results show its recovery plan is working, and the automaker expects to continue the momentum through the remainder of 2015.

Officials stop short of saying when the market gains will translate to the bottom line, preferring to wait to offer any earnings guidance until the automaker’s Q1 financial report is released April 28. Ford of Europe last eked out a profit in Q2 2014, but has been operating in the red for most of the past five years.

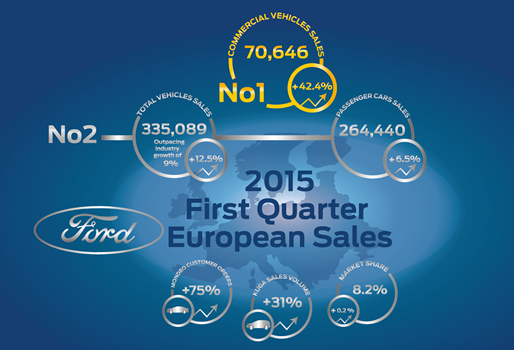

Ford says European sales reached 335,100 vehicles for the January-March period in the 20 markets it tracks, a solid 12.5% gain that outpaced the industry’s 9.0% growth. The automaker’s March performance was even more impressive, rising 14.4% in volume, compared with the industry’s 11.6% gain.

The quarterly results translated into a 0.2-point jump in market share in the quarter, pushing Ford’s stake to 8.2%.

More important, says Peter Fleet, vice president-sales, is the increase in retail/fleet deliveries for the Ford brand overall and its move into the No.1 slot among commercial-vehicle brands.

Ford says 73% of its sales were in the retail/fleet category, with the remainder in the less profitable rental/demo sector. That compares to an industry split of 69/31, meaning Ford is gaining pricing power as it draws new retail buyers to its showrooms.

Ford says 73% of its sales were in the retail/fleet category, with the remainder in the less profitable rental/demo sector. That compares to an industry split of 69/31, meaning Ford is gaining pricing power as it draws new retail buyers to its showrooms.

“We continue to differentiate ourselves from the market by the quality of our business,” Fleet says in a conference call with reporters to discuss the sales results.

He attributes most of the first-quarter sales gains to new product, saying half Ford’s volume came from new or refreshed models. Mondeo sales rose 34% in January-March, Fleet points out, adding, “In fact, orders were up 75% – with sales (skewing) toward retail. So it is drawing new customers for Ford.”

With a new or refreshed C-Max, C-Max Grand, Focus RS, Mustang, Galaxy and S-Max models on the way, the Ford executive expects momentum to continue through the remainder of 2015. Mustang, Fleet says, already has drawn 2,000 orders, though the car has not yet arrived at European dealerships.

“It’s clear new products are a real hit for our customers and driving share up, and we’re seeing that coming through in our brand (pricing power).”

In the commercial-vehicle sector, Ford has risen to No.1 ahead of Volkswagen and Renault via a 13.3% first-quarter volume gain. Transit Connect sales rose 70% and Ranger pickup sales tripled during the period.

Ford’s commercial vehicles “had a fantastic first quarter,” Fleet notes of the sector’s best market-share result in a decade. The brand gained 2.8 points, taking its penetration to 13.3% in the quarter.

Fleet says the European market overall continues to suffer from excess capacity and has benefited somewhat from scrappage incentives in Spain and interest-rate incentives in Russia.

But he credits overall economic improvement as the main driver pushing industry sales to a 15.6 million-unit seasonally adjusted annual rate in the first quarter, outpacing Ford’s forecast for the year of 14.8 million-15.3 million. The automaker could revise its outlook for the year when it reports its January-March earnings.

The Spain incentives, which ran out this week, likely will be extended, Fleet says, though he predicts the government will decrease its outlay and narrow eligibility in response to the market’s underlying improvement.

In Russia, Fleet says Ford already is seeing some benefit from General Motors’ announcement it will pull most of its brands from the market.

GM dealers are approaching Ford about acquiring a franchise, he says, and GM customers are coming to showrooms to see if Ford dealers will service their vehicles in the future, “which we will do, and begin to forge relationships (with those customers).

“(But) Russia continues to be a challenging marketplace for everybody,” Fleet adds, noting the country’s first-quarter SAAR came in at 1.9 million but sales are likely to settle closer to 1.7 million units for the year.