TRAVERSE CITY, MI – A midterm review is built into the U.S. 2025 corporate average fuel economy target, and the European Union has delayed a vote to adopt stringent carbon-dioxide tailpipe limits in 2020.

That has led to speculation in some corners of the auto industry that the most demanding mileage and emissions rules for auto makers might be eased because of concerns about technological feasibility and negative economic impact.

But a surprising new WardsAuto survey reveals engineers and designers tasked with creating the next generation of vehicles are not looking for a reprieve.

Instead, they are optimistic about the future and expecting regulations governing fuel economy and CO2 emissions to become even tougher than today’s U.S. mileage fleet target of 54.5 mpg (4.31 L/100 km) for 2025 and Europe’s 95 g/km CO2 limit for 2020.

More than 1,300 engineers and designers who subscribe to WardsAuto.com and other WardsAuto digital publications responded. The survey was sponsored by DuPont and conducted by Paramount Research in mid-July.

Now in its third year, the WardsAuto/DuPont survey was undertaken as the EU delayed a vote to adopt stringent 2020 CO2 emissions regulations.

This uncertainty, along with the midterm evaluation built into the U.S. 2025 rules stimulated interest in learning the opinions of those working in the executive suites and in the trenches to create new vehicles that meet these standards.

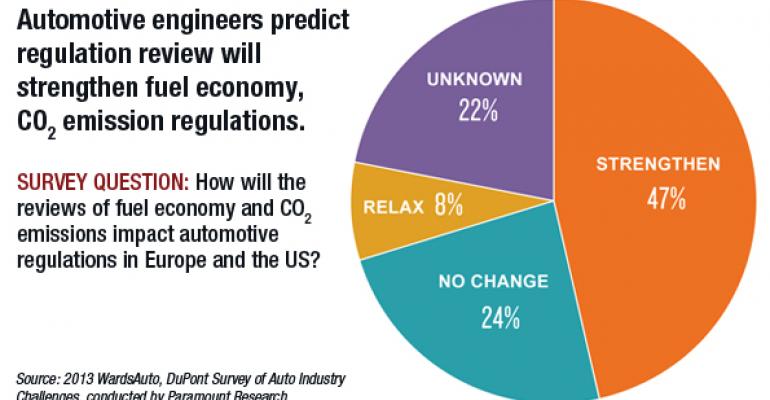

A whopping 47% of respondents say the midterm review of the 2017-2025 standards will result in a strengthening of the laws. Another 24% indicate the standards will remain the same.

The surprisingly upbeat response from automotive engineers and designers, who often complain about government regulations, stems from faster-than-expected technical advances and a growing willingness by auto makers to hire new talent and loosen the purse strings for cutting-edge technologies and lighter-weight materials.

The surprisingly upbeat response from automotive engineers and designers, who often complain about government regulations, stems from faster-than-expected technical advances and a growing willingness by auto makers to hire new talent and loosen the purse strings for cutting-edge technologies and lighter-weight materials.

In the U.S., the new regulations will double the fuel economy of auto maker fleets and cut their tailpipe emissions by half compared with vehicles made in the ’10 model year.

While the coming standards are tough, engineers have grown increasingly optimistic as the fortunes of the industry have improved. Companies are increasing budgets and some of the technologies are succeeding better than planned.

“Technology is proving to deliver what once was thought impossible in terms of power-to-consumption ratios for normally sized vehicles,” says one engineer. “Regulators will leverage this as ammunition to drive stronger standards.”

Says another respondent: “I’m fairly close to the technologies that will allow auto makers to meet the new emissions standards, downsizing, lightweighting, aerodynamics, etc., and I think it will be possible to meet these standards. It’s going to take some change on the consumer end, but it’s possible.”

There is plenty of griping from dissenters about how difficult it will be just to meet the current targets, and how regulators are overreaching in what they are asking auto makers to do. But only 8% predict regulations actually will be rolled back for economic or other reasons.

“Regulations in the auto industry are never relaxed,” one veteran says.

Most respondents appear to agree consumers are focused on fuel efficiency, as the days of relatively cheap fuel likely are gone forever. Interestingly, 36% of respondents report the new regulations are causing some programs to be changed or even cancelled.

However, a deep dive into the comments shows most of the programs being canceled, trimmed or postponed are not related to meeting future fuel-efficiency and emissions targets. But are being shut down to free up resources for more relevant programs.

“Fuel and emissions standards throughout the world are driving significant changes in vehicle design,” says DuPont Performance Polymers President Diane Gulyas. “There are multiple solutions simultaneously getting into the market, and the industry must continue to work in harmony to develop low-emission, fuel-efficient vehicles that consumers want to drive.”

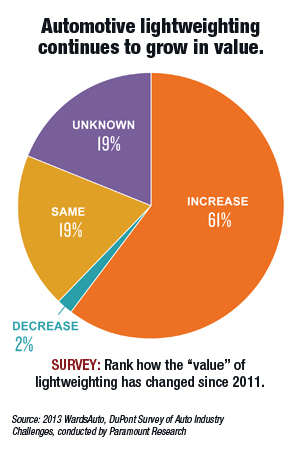

The survey also shows the value of lightweighting vehicles to meet fuel-economy targets is increasing, and that every system in the vehicle is a candidate for reduced mass. In fact, the need for lightweighting is so obvious, some of our respondents let us know they think it is a dumb question.

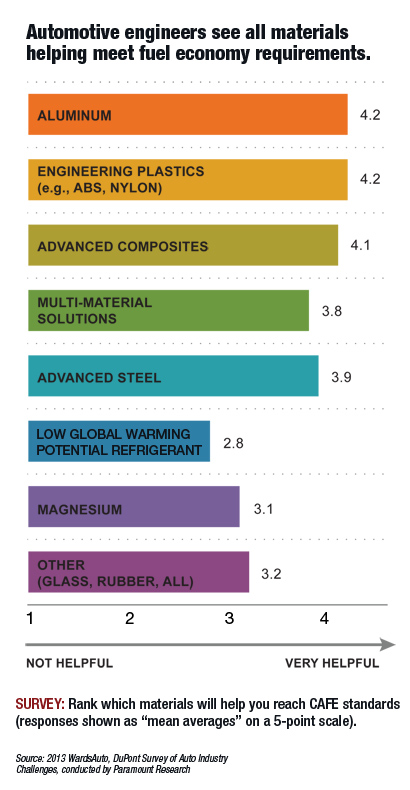

But while last year’s respondents gave a slight advantage to aluminum over plastics and composites as the material that can best help them meet regulations, this year’s respondents say they are looking at all materials on the available menu.

This likely reflects the growing “material-agnostic” strategy many product chiefs are taking with new-vehicle development, aiming simply to use the best material for the job regardless of preconceptions, chemistry or composition.

“We’ve seen a variety of materials-based solutions introduced in the past couple years,” says Mike Day, director-performance polymers development for DuPont in North America. “Development activity with the auto makers is intensifying, especially related to new composite and multi-material solutions that deliver the strength and stiffness needed for performance and safety.”

Engineers make clear that while they are continuing to move forward in optimizing internal-combustion engines, hybrid-electric, plug-in electric and all-electric powertrains, biofuels and other programs, lightweighting is crucial.

Almost every system and part is a target for weight savings, and 2025 is just around the corner in automotive terms, where new product cycles typically last four years or more.

Many of the automotive professionals responding to the survey are savvy about how regulations work and how government rules are loaded with special credits and loopholes that make the targets easier to reach.

One engineer points out the 54.5 mpg fleet fuel-economy target is based on how the National Highway Traffic Safety Admin. evaluates mileage, and not by the tougher Environmental Protection Agency calculation, which should make hitting the targets easier.

But for once, it seems engineers believe they are being given the proper tools and resources to do their jobs, which has been a sore point for decades.