U.S. light-vehicle inventory ended October at an all-time high for the month, with the mix showing car stocks remain stubbornly high, while truck totals foretell expectations of strong year-over-year sales gains the rest of the year.

The mix also portends a combination of higher market spiffs and selective production cuts as the industry adjusts to flattening demand after seven years of growth dating back to mid-2009.

October’s inventory of 3.841 million units was 4.2% above September’s 3.686 million, which also was high for that month. The total was 7.4% above same-month 2015, and topped the previous October peak of 3.803 million units in 2004.

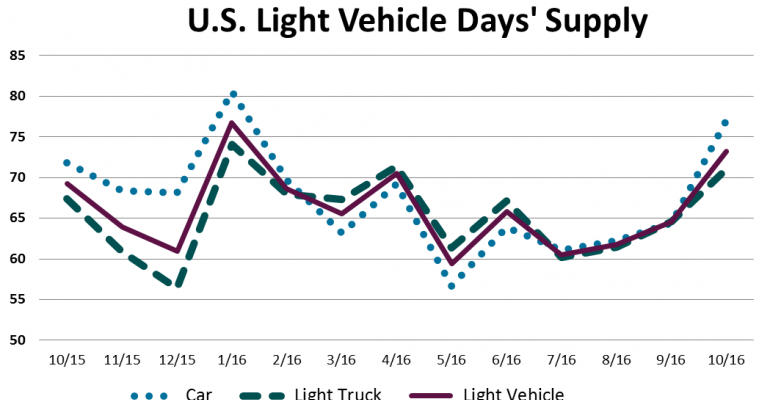

In part because October’s sales finished a little higher than expected, drawing more stock off dealer lots, the month’s 73 days’ supply suggests a good balance for this time of year if sales continue in November-December at the 17.5 million-unit seasonally adjusted annual rate they have averaged over the past three months.

An early look at recent trends and last month’s data indicates a 17.2 million-unit SAAR for November, meaning incentives will have to increase from October to maintain the 3-month average.

Light-truck inventory ended October at 2.347 million units, 14.9% above same-month 2015. Day’s supply was 71, an increase from the prior month’s 65 and like-2015’s 67. Even though above year-ago, October’s total appears well-balanced with demand.

Through the first 10 months of 2016, truck deliveries were running 6.9% above 2015. Fortified with 12-year high inventory heading into November, sales gains should remain strong through the end of the year.

Truck penetration topped 63% in October, a new any-month high. Truck share typically rises from October through the end of the year and could near two-thirds of volume in December.

The biggest segment group, CUVs, rode into November with dealer stocks 21.0% above the prior year. Overall, the CUV inventory total is healthy, but the Small CUV segment is bordering on being bloated, and some excess has crept into Middle CUVs.

Middle CUV is significant because it is the largest segment, accounting for one-in-five vehicles sold in 2016, with about 80% of that total built in North America.

Small CUV, although just 5.5% of the market, has the strongest growth of any segment in 2016. However, year-over-year sales gains have dropped to single digits in the past two months after averaging 53% during the previous 20 months. The segment’s inventory is 27% above year-ago, and its inventory-to-sales ratio is among the highest of all segments.

FCA US, Ford, General Motors, Honda, Mitsubishi, Nissan and Volkswagen each has strong sellers in the Small and Middle CUV segments, with inventory higher than needed to meet demand.

After a year-over-year sales increase, based on daily selling rates, of 13.5% in October, pickups are set to continue hefty gains the rest of the year. Dealer inventory of pickups headed into November 12.5% above year-ago, with nearly all models up by double digits. The group’s only vehicle below year-ago was the GMC Sierra.

SUV stocks were up 15.0% in October from like-2015, and inventory of Large Vans rose 13.3%.

Despite gains in most other major truck groups, Small Van inventory ended October down 13.2%, which was in line with the segment’s recent sales downturns, including a 19.1% shortfall last month.

Cars, however, still are running on the high side. Oct. 31 days’ supply of 77 was well above the 70 days’ considered optimum for this time of year. Car stocks totaled 1.494 million units, 2.6% below same-period year-ago. Year-to-date sales in 2016 were 9.3% below 10-months 2015.

Car demand is weak in all segments, but the Middle Car group is the area manufacturers are having the toughest time paring inventory enough to keep in balance with demand.

In total, year-to-date Middle Car deliveries are 12.3% below like-2015, with share dropping to 15.3% from 17.5%. However, inventory remains 1.6% above year-ago.

With the three exceptions of the Buick Regal, Chevrolet Malibu and Subaru Legacy, sales for every vehicle in the group were down, many of them in double digits. However, 11 in the group have higher inventory compared to a year ago, including some high-profile models such as the Honda Accord, Nissan Altima, Toyota Camry, Prius and Volkswagen Passat.

By source, inventory of domestically produced LVs totaled 3.114 million units in October, 7.0% above same-month 2015. Oct. 31 days’ supply was 76, compared with 72 a year ago. Import stocks totaled 727,329 units, 9.0% above like-2015, with a 64 days’ supply, compared with 57 the prior month and 59 a year ago.