U.S. light-vehicle inventory ended October less than 1% above year-ago but is robust enough to handle a year-end flourish, especially if the industry continues the 18 million-plus seasonally adjusted annual rates of the previous two months.

Inventory ended October at 3.58 million units, 4.9% higher than September. September-to-October increases usually are closer to double-digit gains, but October’s selling period was unusually long and included part of November. Consequentially, November has a shorter sales period meaning less stock is needed to meet its demand, and – barring a major increase in incentives – stock levels should rise more than usual by the end of this month as the industry heads into December.

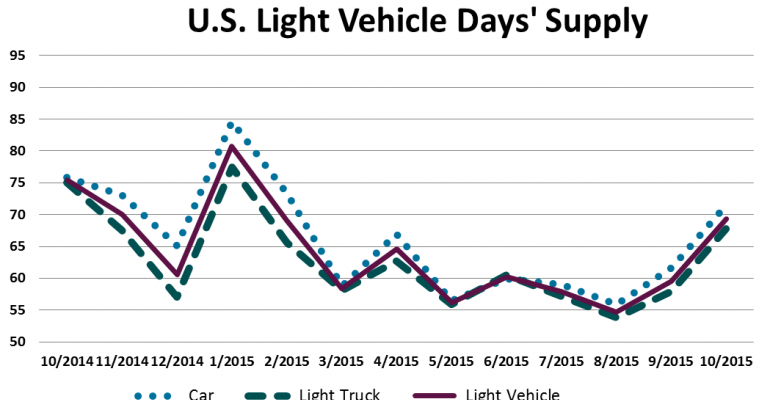

Days’ supply increased from September’s 59 days’ to 69 on Oct. 31, but was below year-ago’s 75. A days’ supply in the low 70s is typical for October in a healthy market, but the slightly lower count is not a hindrance to meeting demand even if it remains at an 18 million-unit SAAR level.

The fundamentals indicate November’s SAAR will slide below 18 million and rebound in December. Despite a shorter selling period of 23 days vs. 25 a year ago, November’s volume still should be relatively close to year-ago’s total. December’s volume likely will be the highest of the year, topping May’s 1.63 million, due to it having a longer sales period than usual. In addition, October’s results seemed to show manufacturers are amenable to maintaining sales spiffs.

In fact, demand could be goosed by Ford’s announcement of a generous discount program for the last two months of the year. For Ford, volume increases from the program likely will be felt most with cars, where, like many others, it has been weak. It also could mean big gains for the Ford Escape and stronger year-over-year comparisons for the Ford F-Series pickup. Dealers are well-stocked with Escapes and F-Series inventory is nearly up to year-ago levels after a long build-up for the new F-150.

At this point, it appears market incentives, including any significant response to Ford’s outlays, will determine whether the year ends closer to 17.4 million or 17.5 million – although another possible impact with negative implications is an underestimation of the pull-ahead due the surge to an 18.0 million-unit SAAR during the previous three months.

A key to how much more incentives might drive up volume through the end of the year is whether and by how much market-leader General Motors enhances its programs. In times past, it was GM’s lead on discounting that lifted demand for 1- or 2-month periods to huge above-trend levels.

Except for some specific vehicles – mostly cars – neither GM nor Ford is laden with an excess of stocks. GM’s Oct. 31 total was 10.8% below year-ago, and Ford was up only 0.7%. Most major automakers, except possibly FCA US with stocks up 17.9%, are not overburdened with inventory and don’t have a lot of pressure to unload weak-selling vehicles.

Thus, there might not be as much impetus for the rest of the industry to match Ford’s programs.

By vehicle type, truck inventory is solid, while car stocks continue to dwindle in line with weakening demand.

Light-truck stocks ended October at 2.04 million units, 5.8% above year-ago. Oct. 31 days’ supply was 68, compared with September’s 58 and same-month 2014’s 75.

Among truck sectors that have seasonally strong sales in the final quarter of the year, stocks of luxury CUVs and SUVs combined were up 18% from year-ago. However, pickups were down 8.6% from year-ago, including a 9.1% shortfall in the Large Pickup segment, where only the Ram Pickup sported higher stocks.

Inventory of the highest-volume LV segment group, CUVs, was up 14.4% year-over-year on Oct. 31. Parsing out the CUV group, coming off a 33% year-over-year sales gain last month, inventory in the hot-selling Middle Luxury and Large Luxury segments combined still was up a healthy 16.8%. Additionally, inventory for Middle CUVs, the largest LV segment, rose 7.8%. Rife with new products and October sales penetration of 5.3% almost double same-month 2014, Small CUV inventory spiked 83%.

Inventory of cars ended the month at 1.53 million units, 5.4% below year-ago. Luxury Cars were above year-ago totals, while the Small, Middle and Large Car groups were below like-2014.

Luxury Car inventory headed into November 2.6% above year-ago, which is in line with year-to-date sales – up 1.7% – and that Q4 is the highest-volume quarter of the year for the segment. Interestingly, Ford’s year-end discount program – at least so far – excludes its Lincoln luxury brand, which is posting weak car sales. Other significant luxury brands, including Audi, BMW, Cadillac, Lexus and Porsche, also have recently experienced sagging car deliveries. There is potential for that segment to become more heated by the end of the year.