U.S. light-vehicle inventory ended September at its highest ever level for the month, as attempts to reduce car stocks failed to keep up with sliding sales.

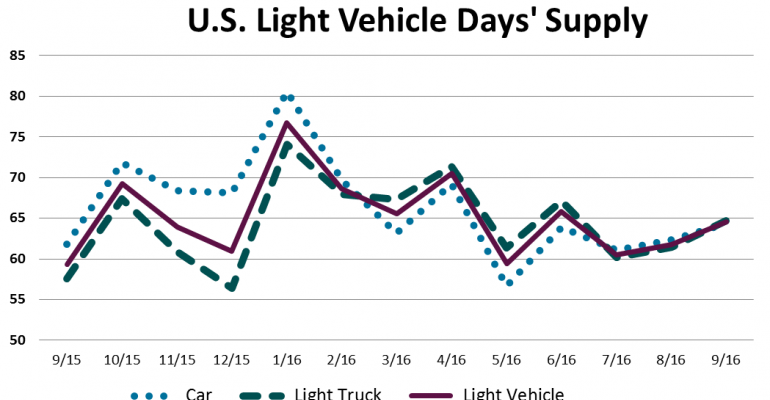

Sept. 30 inventory totaled 3.69 million units, up 8.1% from like-2015 and 3.1% above August’s total. Days’ supply was 65, compared with 62 the prior month and 59 a year ago. A 60 days’ supply is an optimum level heading into October.

Although car inventory ended the month 3.5% below year-ago at 1.43 million units, stocks in the three major segment groups – Small, Middle and Luxury – are higher than what WardsAuto estimates would be a good balance with current demand. Basically, demand for cars is falling faster than automakers can pare inventory, although most are making earnest efforts to do so.

Year-to-date car sales are down 8.7%, and penetration is an all-time low 40.3% and is likely to end the year below 40%.

Cars most in excess are in the Middle Car segment group. Declining sales of makes such as the Ford Fusion, Honda Accord, Nissan Altima, Toyota Camry and Prius and Volkswagen Passat are keeping dealers overloaded with midsize sedans. Specialty vehicles in the group, including the Chevrolet Camaro, Dodge Challenger, Ford Mustang and Nissan Z, also are overstocked.

Inventory of trucks ended September at 2.26 million units, 16.9% above year-ago. Days’ supply was 65, an increase from August’s 61 and year-ago’s 58, but not out of line with the growing demand. Although sales in total are expected to decline from year-ago in Q4, trucks are expected to rise.

A fierce battle could be brewing among pickups, especially the Large segment.

In recent years, Q4 has been the highest volume quarter for Large pickups, which is forecast to be the case again this year.

Pointing to a Q4 pressure cooker in the segment is inventory 11.1% above year-ago. Levels for the two leaders, Chevrolet Silverado and Ford F-Series, are running above demand, and Nissan and Toyota are building up stocks of the Titan and Tundra, respectively. Further adding to the mix is FCA’s apparent intent to remain competitive in the segment, based on the Ram pickup’s 29% year-over-year sales increase in September while the rest of the segment declined 6.3%.

Historically, Small Pickups do best in the second quarter, but General Motors’ re-entry into the segment two years ago reignited demand. That along with fresh versions of the Honda Ridgeline and Toyota Tacoma, and Nissan’s efforts to remain viable with the Frontier, have accelerated the segment’s growth to the extent seasonal trends are askew and Small Pickups are expected to post their strongest quarter in October-December.

Sept. 30 inventory of domestically built LVs totaled 2.98 million units, 7.5% above year-ago and equal to a 67 days’ supply, compared with 64 in August and 61 in same-month 2015. Import vehicles ended the month with a 57-days’ supply, up from 54 in both the prior month and a year ago. Inventory totaled 706,446, 10.7% above year-ago and highest September total on record.