Following two consecutive quarterly output records, North American car and truck makers appear to be easing up on the throttle a tad in October-December, but the pace still is strong enough to nudge production for the year to an all-time high.

Booked for completion in the final three months of 2015 are 4,404,100 vehicles, 1.8% ahead of prior-year’s 4,326,600 units.

While not a record, it does run a close second to the 4,429,811-unit peak reached in Q4 1999 before the market softened and output fell to 4,066,109 in the same period a year later.

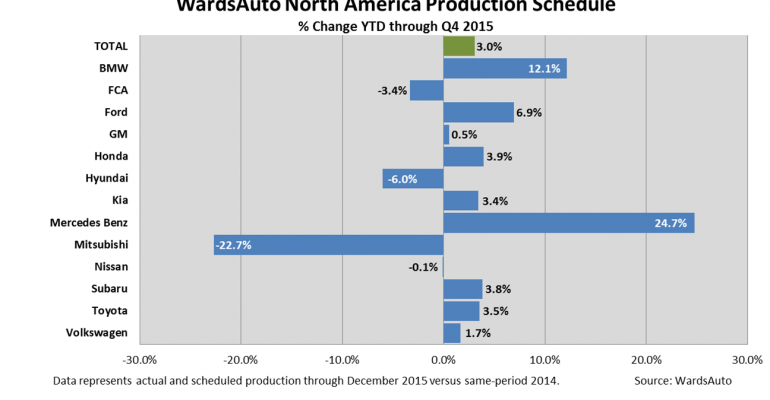

Barring any unexpected slowdowns in the next few months, 2015 now is set to end with 17,946,300 vehicles built, 3.0% more than the 17,415,500 units turned out in 2014 and 1.6% ahead of the prior benchmark of 17,659,700 established in 2000.

Trucks are the driving force behind the new industry output record, besting the 10.0 million mark for only the second time in history.

With the Q4 truck slate calling for assembly of 2,629,300 light, medium, and heavy units, a gain of 3.0% in like-2014’s 2,553,200, output for the year is pegged at 10,768,700 trucks, or 4.2% more than the prior record of 10,332,200 reached just a year ago.

Although seven of 15 manufacturers have initial Q4 plans calling for fewer total vehicle assemblies in October-December vs. year-ago, only four have slated fewer light trucks for completion.

Among the major producers, only Fiat Chrysler Automobiles so far has lightened its Q4 production plans appreciably, with schedules calling for output of 12.4% fewer trucks as opposed to a shortfall of just 1.1% in cars.

Although Ford has yet to unveil official October-December plans, based on the Dearborn automaker’s new-product launches and strong demand, it is expected to build 19.5% more trucks in the final three months than it did in like-2014. Ford car output is forecast to rise 7.6%.

At the same time, General Motors plans to build 3.5% more trucks in the quarter vs. year-ago, but that mostly is offset by a 4.1% decline in car assemblies.

In the same vein, Nissan, with a new Titan pickup on tap, has slated a 2.8% light-truck output increase compared with an 0.7% rise in car output.

Meanwhile, Honda is stepping up light-truck output 11.3%, a hike that more than offsets a 3.6% decline in fourth-quarter car production.

Although Toyota has initially pegged Q4 truck assemblies at a level 0.4% under like-2014, it is expected to add additional units as the quarter progresses. Toyota car output also is set for a 3.5% decline.

Based on current plans, FCA, Ford and GM will build a combined 9,267,200 vehicles in 2015, 1.4% more than the 9,139,000 units finished in 2014, netting them a 51.6% production share in 2015, down from 52.5% a year earlier.

Transplants are expected to close the books with output of 8,252,000 units, or 4.7% more than prior-year’s 7,881,600 vehicles, grabbing a 46.0% share as against 45.3%.

Dedicated medium- and heavy-truck producers are set to end the year with 427,100 vehicles, 8.2% more than the prior year’s 394,900 units. They account for 2.4% of industry output this year vs. 2.3% in 2014.