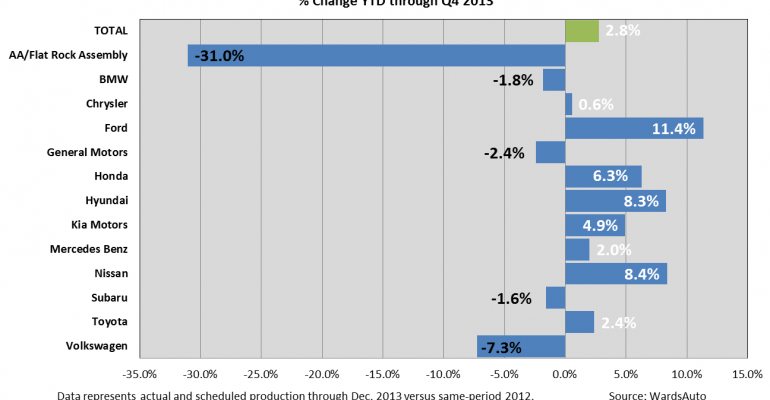

Quarterly North American car and truck production is slated to wrap up with about the same small year-over-year gain as when 2013 began, 0.4%, although the year will go down as fifth-best in history with a 2.8% increase from 2012 to 16,234,600 units.

Overall, auto makers have penciled in 3,912,800 vehicles for completion in October-December, compared with 3,895,700 in like-2012. Truck output accounts for all of the gain, unlike first-quarter results when cars bested prior-year by 3.6% and trucks lagged 2.0% behind.

Indeed, strong light-truck sales have prompted a 3.5% increase, to 3,912,800 units, in the number of trucks slated for assembly in the fourth quarter, with virtually all major producers slating additional volume. Truck output totaled 3,895,700 units in like-2012.

Increases range from 2.7% at Ford, already building at a rapid rate a year ago, to 15.6% at lower-volume Nissan, where until recently truck builds had been languishing.

BMW, down 17.7%, and Mercedes, off 9.5%, are alone among light-duty marques slating fewer trucks for assembly in Q4 than year-ago. Dedicated medium- and heavy-duty manufacturers also are set to underbuild like-2012, by 3.1%, thanks to sluggish economic growth.

Car production, on the other hand, will close out 2013 with 1,663,500 units scheduled for October-December, 3.4% fewer than the prior year’s 1,722,200.

Only Ford, the Ford-controlled Flat Rock Assembly (formerly AutoAlliance) operation, Honda and Kia show measurable increases in Q4 car production, with hikes of 16.8% at Flat Rock, 14.6% at Ford, 9.2% at Honda and 3.5% at Kia.

Car-production increases elsewhere range from 1.4% at Toyota to 0.4% at Subaru and 0.2% at Nissan.

The fourth-quarter slate comes on the heels of a revised third-quarter output plan now expected to reach 3,905,700 units, up 4.2% from the 3,749,100 year-ago, after fully accounting for midsummer vacation and model-changeover shutdowns.

Included in the latest third-quarter plan is a robust September slate some 22,100 units more than it was a month ago, thanks mainly to the 10,300 cars added to General Motors’ plan and Chrysler’s 6,000 additional trucks.

Although output for the year won’t pose any threat to 2005’s record 17,659,700 vehicles or the 17,616,121 turned out in second-ranked 1999, it will be the industry’s fifth-best performance, just shy of the 16,318,783 vehicles built in fourth-best 2005 and up considerably from 10th-ranked 2012’s 15,797,800.

The Detroit Three account for 52.8% of scheduled 2013 output, a notch ahead of 52.7% in 2012. Transplants edge up to 45.2% from 45.0% and heavy-truck makers dip to 2.0% from 2.3%.