Inventory levels are pointing toward a slowdown in U.S. sales in April compared to March.

Mar. 31 U.S. light-vehicle inventory totaled 3.595 million units, 2.0% below year-ago, and nearly flat with the prior month.

The lower inventory could mean an evening out from the March sales surge that jumped to a 17.1 million-unit seasonally adjusted annual rate after tracking at 16.4 million over the previous two months.

March’s total lifted the 2015 year-to-date SAAR to 16.6 million. To maintain that total, April’s sales volume will have to equal a higher percentage of March’s inventory than indicated by usual month-to-month patterns. It’s doable, but likely would mean some increased incentives on cars to get there.

Car penetration in March was a little higher than expected, in part due to some apparent incentive activity for select models that led to unusually high year-over-year gains that were not in line with previous months’ comparisons. March car inventory fell 2% from the prior month and was 7% below year-ago.

Trucks, which are driving demand, posted a 1% inventory increase from February, and are 3% above year-ago. That’s enough to keep sales around the Q1 pace. However, there are some pockets inside the truck numbers that could act as limiters.

Inventory of Middle CUVs, the largest segment, is 1% below year-ago even though year-to-date sales are up 9%.

Also, with Ford’s F-150 yet to reach full availability, Large Pickups could record their first year-over-year decline, based on daily selling rates, since January 2014. Large Pickup inventory ended March 12% below year-ago.

Inventory of small vans was up 27% from year-ago at the end of March. But, because FCA US has stopped building its minivans for three months to retool for new models, inventory will fade fast in that segment. In fact, the decline already started in March. Despite robust stocks compared with last year, March small-van sales were down 12% from year-ago because FCA’s dealers already were pulling back on pushing them.

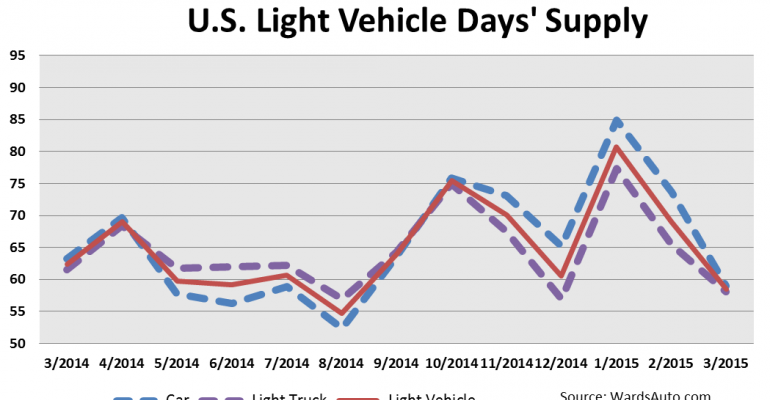

On the plus side, although days’ supply ended the month lower than the estimated healthy level of 60 to 63, it was more a function of somewhat artificially high daily selling rates in March rather than lean inventory volumes

March 31 LV days’ supply of 58 was an 11-day drop from February, a little higher than the typical 6- to 7-day month-to-month decline.

March’s inventory of domestically made LVs totaled 2.955 million units, nearly flat with the prior month, and 1% below year-ago. Days’ supply was 61, compared to February’s 71 and year-ago’s 65.

Import inventory ended the month at 640,000 units, slightly below the prior month and 7% below year-ago. Days’ supply was 48, well below the prior month’s 61 and year-ago’s 52.