It’s no secret vehicles and engines are trending smaller around the world, including in the large-truck haven of North America.

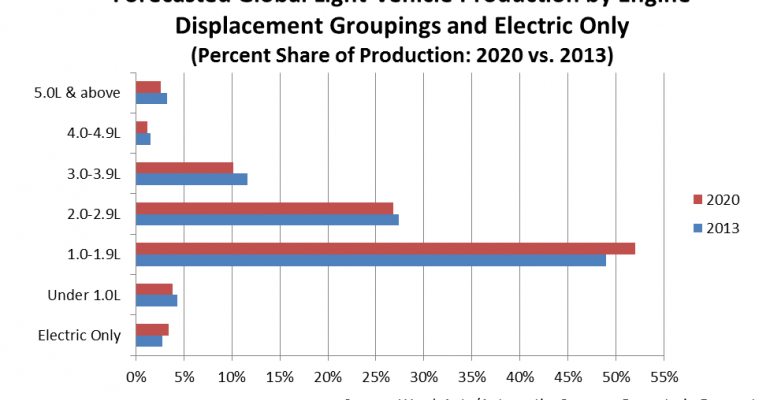

The WardsAuto/AutomotiveCompass global powertrain forecast projects that more than half the light vehicles built globally in 2014 will have engines with displacements from 1.0L to 1.9L, compared with 49% in 2013. By 2020, 52% of LVs will sport engines in that range.

The difference is not much in percentage terms, but translates to additional annual volume of 15 million units for 1.0L-1.9L engines by the end of the decade.

In addition to more stringent emission standards in most markets, the move toward small is being spurred in large part by growth in emerging markets where smaller vehicles already reign.

Ironically, the trend to smaller will not come as much in downsized cars as it will is in light trucks. A rise in penetration between now and 2020 is expected in A-size models, or minicars. But the B- and C-size cars are forecast for declines in share, although both groupings by far will remain the biggest segments globally. The majority of growth will be in B- and C-size CUVs.

Based on groupings for forced-induction engines of under-1.0L, 1.0L-1.9L, 2.0L-2.9L, 3.0L-3.9L, 4.0L-4.9L and 5.0L-and-above, LVs in the 1.0L-1.9L range are the only group forecasted for an increase in penetration through 2020. Also included in the outlook are electric-only LVs, which are forecasted to double share from 3% in 2013 to 6% in 2020.

However, engine downsizing is not occurring just from more output of smaller LVs. Penetration of smaller engines also is increasing in large LVs.

Wards/AC forecasts 2.0L-2.9L engines in large LVs, including CUVs, pickups, SUVs and vans, will become the No.1 grouping in those vehicles by 2018. Penetration for that range in large LVs will rise from 26% in 2013 to 30% in 2018, culminating at 31% by 2020.

Production of large LVs with engines at 5.0L-and-above, forecasted at 32.5% in 2013, currently is the lead range. The 5.0L-above share will temporarily rise in 2014 to 32.8%, then steadily decline to 28% by 2020.

The driver of 5.0L-plus engines is North America which accounts for 90% of LVs built with those engines. Europe accounts for 6% and 4% are assembled in Asia.

In 2013, 15.1% of North American LVs will have 5L-plus engines, but penetration will fall to 12.9% in seven years.