The global auto industry’s recovery is taking firm hold. But higher volumes, key stakes in emerging markets and some strategic portfolio management are what is and likely will continue to separate the real winners from the rest of the pack, concludes a new study released today by The Boston Consulting Group.

BCG zeroes in on annual total shareholder return (TSR) post-2009 recession in its study, “The 2014 Automotive Value Creators Report: A Comeback in the Making,” which ranks the performance of automakers and suppliers around the world.

OEs that lead the list of best performers in the 2009-2013 period skew toward emerging-market automakers (and motorcycle producers), with none of the Detroit Three or European companies making the top 10.

No.1 in the ranking is Great Wall Motor, followed by two other Chinese manufacturers, Brilliance China and Changan Automobile. The latter two owe much of their success to their joint ventures with BMW and Ford, respectively, BCG notes.

Japan’s Fuji Heavy Industries (Subaru) makes the list at No.4, commercial-vehicle maker Hino is No.7 and Korea’s Kia settles in at No.8. India’s Tata and Mahindra & Mahindra also make the top-10 list that is rounded out with a couple motorcycle makers.

Overall, the auto industry is pacing above other industries in recovering from the Great Recession, BCG says. The sector’s median TSR over the 2009-2013 period was 33%, well above the 26% rating for the 26 industries tracked by BCG and marking a strong recovery from the 2008 financial crisis that saw U.S. automakers, alone, post nearly $75 billion in red ink.

“The automotive sector has enjoyed a good run, but sustaining that standout performance will be a challenge,” Xavier Mosquet, BCG senior partner and a coauthor of the report, says in a news release.

The keys to doing that are evident in the numbers, the consulting firm says.

Those firmly planted in emerging markets show some of the best results, tabulating TSRs ranging from 36% to 49%. That compares with a 23%-35% range for those focused on mature markets.

In addition, higher-volume automakers, flexing their economies-of-scale muscle and increasing unit sales significantly over the period, also tended to notch higher TSRs. But BCG cautions there are no guarantees that come with higher volumes. China’s BYD posted annual vehicle sales growth of 15%-20% over the period, but its margins barely budged, climbing only about 2%, the report notes.

Automakers also tend to show positive results from product innovation and improvements, with BCG citing Hyundai specifically for its drive to improve quality and content.

OEs that better manage their portfolios also benefited, the report says, pointing to Ford’s and General Motors’ moves to simplify their brand portfolios and Fiat and Tata expanding theirs through acquisitions of Chrysler and Jaguar Land Rover, respectively.

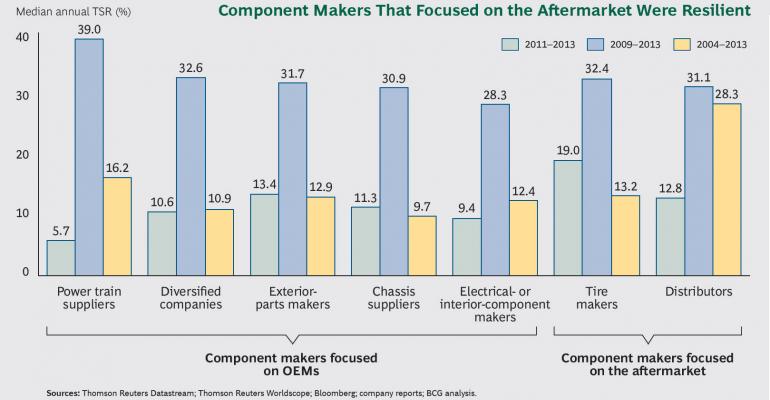

Suppliers followed a similar path as automakers, posting a 33% median annual TSR over the period since 2009, placing the sector among the highest of the 26 industries tracked by BCG. Best performers were Plastic Omnium, Dana, TRW, Tenneco and Linamar.

As with the OEs, the biggest in the supplier sector tend to do the best as well, BCG says, adding a global footprint will be needed to compete effectively in the future.

By segment, powertrain suppliers recorded the best median TSR at 39%, fueled by a regulatory climate that is forcing higher fuel-economy ratings and driving automakers toward more innovative and costly powertrain technology.

BCG's analysis looks at the various sources of TSR, including a company’s revenue growth, margin change, change in valuation multiple and cash-flow contribution.