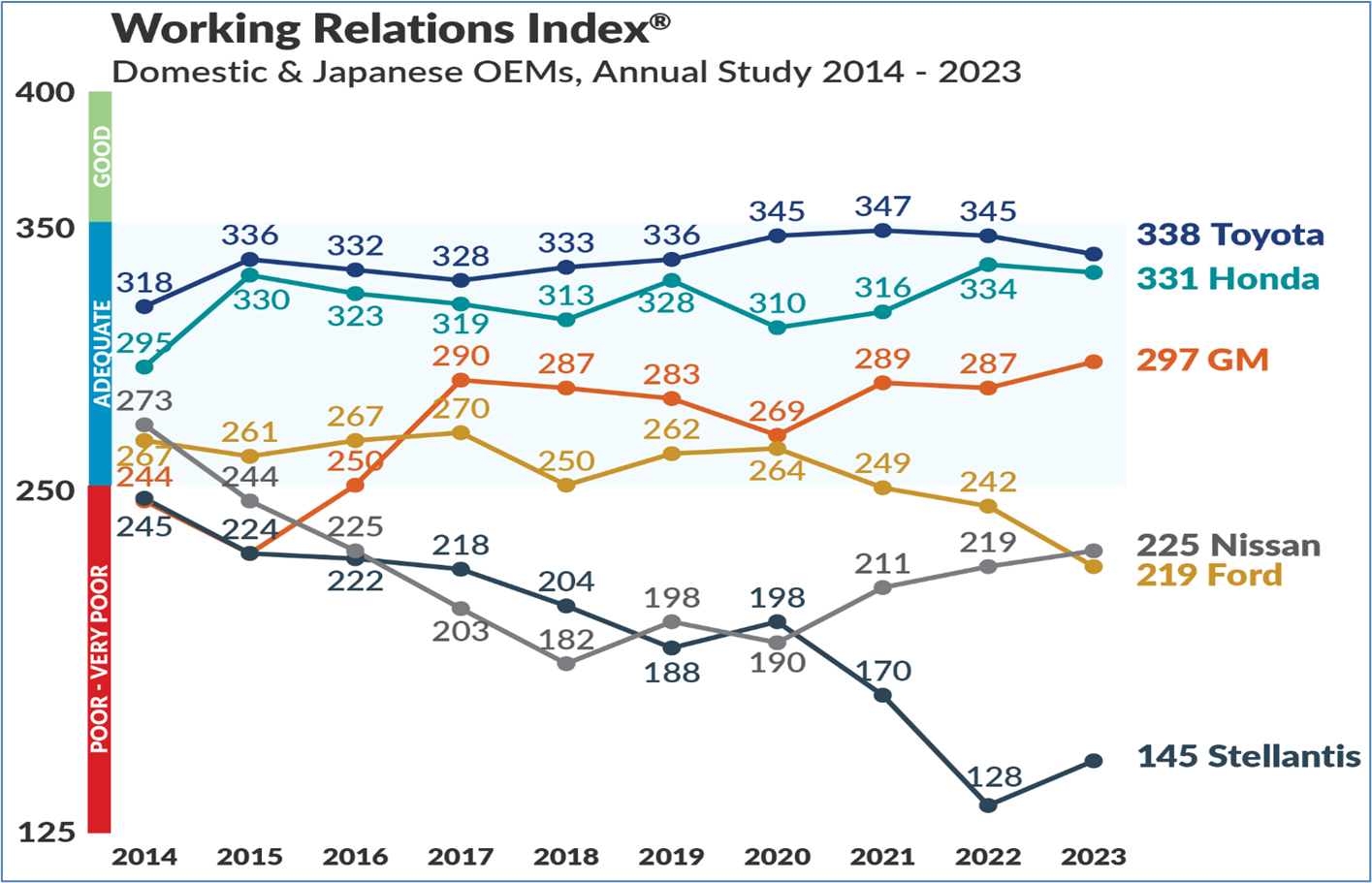

Toyota remains ranked No.1 in the 23rd annual North American Automotive OEM-Supplier Working Relations Index Study conducted by the Plante Moran business analytics firm.

Honda and General Motors again place second and third, respectively, in the evaluation of relations between U.S. automakers and their suppliers. Ford falls to fifth place after its WRI score drops for a third straight year, while Nissan improves its score for a third consecutive year to move into fourth place.

Stellantis reverses two years of decline with a 17-point gain, the largest among the six OEMs studied, but remains in last place with a 145 (out of a possible 400) score. Ford’s 23-point decrease to 219 is the biggest, while Nissan rises six points to 225. First-place Toyota’s score is 338, down from 345 in the 2022 WRI.

The 2023 study notes the industry is undergoing major changes because of the shift to electric vehicles, and says suppliers identified several common issues critical to OEM success:

- There cannot be a disconnect between OEM senior management’s words and front-line buyers’ actions.

- OEMs need to ensure purchasing staffs have the experience and training to understand new EV technologies, and internal relationships to engage with engineering and manufacturing as the OEMs reduce and reorganize staff.

- OEMs need to articulate and communicate product plans and technology requirements to suppliers for suppliers to know where they and their products fit into long-term strategies.

- OEM decision-making need to be located nearby and reinforce where supplier sourcing and manufacturing occurs.

The WRI measures the total commercial relationship between OEMs and suppliers, which is a function of perceived trust, timely communication, mutual profit opportunity, assistance and a reduction in friction.

“The industry continues to face unprecedented challenges in the shift to EVs that unless effectively addressed will only get worse,” says Dave Andrea, principal in Plante Moran's Strategy and Automotive & Mobility Consulting Practice, which conducts the annual study.

“During COVID, a ‘war room’ approach was adopted to quickly resolve critical issues. That approach is what auto manufacturers need to maintain during the transition to EV technologies,” Andrea says. “The industry needs that level of collaboration, even without the pressure of a crisis.”

Automakers pay close attention to the study because positive supplier relations benefit OEMs with better pricing, more investment in innovation and technology, more sharing of technology and better supplier support. All these factors contribute to the OEM’s operating profit and competitive strength.

The WRI results were based on an online survey of 715 salespersons from 459 Tier 1 suppliers who were asked to rate their automaker customers across eight major purchasing areas broken down into 20 commodity areas. The sales personnel, whose companies supplied componentry accounting for 60% to 70% of the vehicle’s value, provided data on 2,301 buying situations, Andrea (pictured, below left) tells Wards.

Stellantis recovered after earning an abysmal 128 WRI score in 2022, which Andrea attributes to the upheaval resulting from the previous year’s merger of Fiat Chrysler and PSA Group. Similarly, he links Ford’s slump to fifth place in the 2023 survey to the automaker’s formation of dedicated business units for electrified vehicles (Ford Model e) and internal-combustion-engine vehicles (Ford Blue) in 2022.

Stellantis recovered after earning an abysmal 128 WRI score in 2022, which Andrea attributes to the upheaval resulting from the previous year’s merger of Fiat Chrysler and PSA Group. Similarly, he links Ford’s slump to fifth place in the 2023 survey to the automaker’s formation of dedicated business units for electrified vehicles (Ford Model e) and internal-combustion-engine vehicles (Ford Blue) in 2022.

“You’ve got to manage carefully how you de-source suppliers on the Ford Blue side and re-source suppliers on the Model e side,” Andrea says. “There is a lot of uncertainty about their long-term plan. It shows how important internal relations and communications are.”

Plante Moran lists these takeaways from the 2023 study:

- OEMs have improved their supplier relations by incorporating the WRI findings in their personnel performance metrics, corporate strategic planning processes and communication strategies allowing them to better leverage their suppliers.

- Strong working relations with suppliers are more than external. An improving WRI reflects improved OEM cross-functional internal relations and indicates how well purchasing, engineering and manufacturing are working together – a critical factor in achieving faster product development.

- New market conditions, such as supply chain disruptions and new technologies that change product plans and manufacturing strategies, require that short- and long-term forecasts and production schedules be more accurate and be communicated promptly.

- Cost-recovery mechanisms should not be judged in isolation. Inflation-driven cost increases and adjustments need to be addressed in a timely manner that is consistent, tested and supported by OEM and supplier cost reduction efforts.

- OEMs that effectively address these issues are generally stronger customers of choice for suppliers and rate them better on perceived trust, supplier business return on investment and rewarding suppliers for high performance.

Trust and communication between OEMs and suppliers are cornerstones of the WRI study; the trust rankings almost exactly track the overall scores, with Toyota, Honda and GM rated highest, Ford barely ahead of Nissan and Stellantis improving substantially from 2021 but still ensconced in last place.