Automakers are in a mad technological rush, the likes of which we’ve never seen before. They need to convert their fleets to battery power, charge them faster and give them longer range. They need to define their cars in software and run it on new computing systems using new electronic architectures that are cyber-hardened. They need to make their cars safer, autonomous and connected. And they need to do all this before the decade is out.

The only way they’ll get this done is with more research and development. Keep in mind that when you say R&D, most people conjure up images of scientists in white lab coats working with high-tech equipment. And that’s typically how research is conducted. But then there’s the “D” part of R&D, and this is where automakers book the cost of developing new cars, trucks and vans. So, R&D spending is a reflection of both research and new-product development.

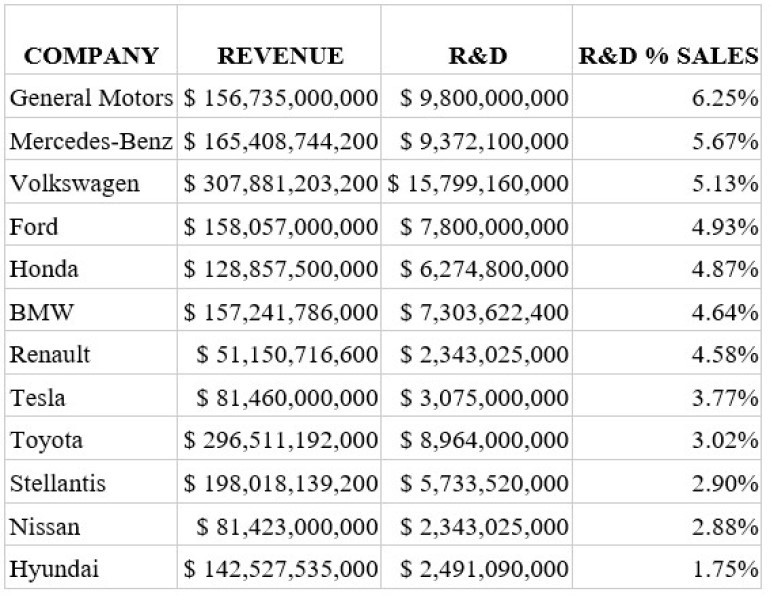

While spending more on R&D does not automatically pave a path to victory, the automakers which spend more will likely come out ahead of those who spend less. Let’s go through the field and see how the top automakers stack up against each other (see chart, below, compiled from automaker financial reports).

The Volkswagen Group spends more money on R&D than any other automaker – by far. It spent nearly $15.8 billion last year, 60% more than anyone else. That shouldn’t be too surprising. VW has a lot of mouths to feed with all of its brands including VW, Audi, Porsche, Skoda, SEAT, Cupra, Bentley, Lamborghini, Bugatti and Ducati.

Next comes General Motors, with $9.8 billion, followed closely by Mercedes-Benz at $9.3 billion and Toyota at $8.9 billion.

Then we come to another cluster including Ford at $7.8 billion, BMW at $7.3 billion, then another with Honda at $6.2 billion and Stellantis at $5.7 billion.

At the bottom of the list is Tesla at $3 billion, Hyundai at nearly $2.5 billion and Nissan and Renault at $2.3 billion.

But these numbers only tell part of the story. To get a better apples-to-apples comparison, we’ve got to look at that R&D spending as a percentage of the total revenue of a company. For example, it’s not a surprise that VW spends more on R&D than Renault because it’s such a big company compared with Renault. But when you look at R&D as a percentage of total revenue, you get a much better picture of who’s devoting more of their resources to research.

On that basis, GM jumps to the top of the list. It devoted 6.25% of its revenue to R&D last year, more than anyone else. Next was Mercedes at 5.7% and VW at 5.1%. Then comes a clump of companies in the 4% range, including Ford and Honda at 4.9%, and BMW and Renault at 4.6%.

Below industry average were Tesla at 3.8%, Toyota at 3%, and Stellantis and Nissan at 2.9%.

At the bottom of the list is Hyundai at only 1.75%, which is bizarre since Hyundai, Kia and Genesis are coming out with so many new vehicles, especially electric ones. Either Hyundai has a magical low-cost way of developing new products, or Korean companies book their R&D expenses very differently than everyone else. I suspect the latter.

Here’s something else these numbers tell us: The automakers that have been kind of dragging their heels on developing EVs are spending less on R&D. Toyota, Stellantis, Honda and Nissan are not devoting as much money to EVs. But that also means, as they move into doing more EV development, their R&D spend is going to have to go up – probably by a lot. That will likely affect their bottom lines, meaning their profitability and stock price could take a hit.

Meanwhile, the companies that are investing more heavily in EVs right now, like GM, Mercedes, VW, Ford, BMW and Renault, are probably going to get over the hump before the others. That means that in another two to three years or so their R&D spend could level off, letting them drop more money to the bottom line.

When it comes to Tesla, I think its R&D spend is below industry average because last year it didn’t come out with any new product. My guess is it will start booking expenses this year for developing the Semi, and later this year for the Cybertruck. I think we’ll see a higher number for R&D spending when Tesla reports its finances for 2023, but I was surprised to see the company so far down the list.

When it comes to Tesla, I think its R&D spend is below industry average because last year it didn’t come out with any new product. My guess is it will start booking expenses this year for developing the Semi, and later this year for the Cybertruck. I think we’ll see a higher number for R&D spending when Tesla reports its finances for 2023, but I was surprised to see the company so far down the list.

R&D spending is only a guideline for us to follow; it doesn’t guarantee success. In a few years, we’ll know who got the most bang for their R&D buck. But one thing’s for sure: The automakers which spend proportionally less than their competitors are unlikely to beat them in the marketplace.

John McElroy (pictured, left) is the President of Blue Sky Productions, which produces “Autoline Daily” and “Autoline After Hours” on www.Autoline.tv and the Autoline Network on YouTube. The podcast “The Industry” is available on most podcast platforms.