Ford won’t spin off its battery-electric-vehicle operations, but it is dicing the company up into three super groups with the aim to cut costs, speed innovation and grow volume and revenue in three key areas.

Under the reorganization, Ford Blue will incorporate existing internal-combustion-engine operations and products, including key revenue generators such as the F-Series and Maverick pickups, Bronco and Explorer SUVs and Mustang sports car.

Ford Model e will encompass development of BEVs and all related components, as well as lead on software development that will be used by both electrified and ICE vehicles.

A third arm, Ford Pro, will focus on Ford’s commercial-vehicle business.

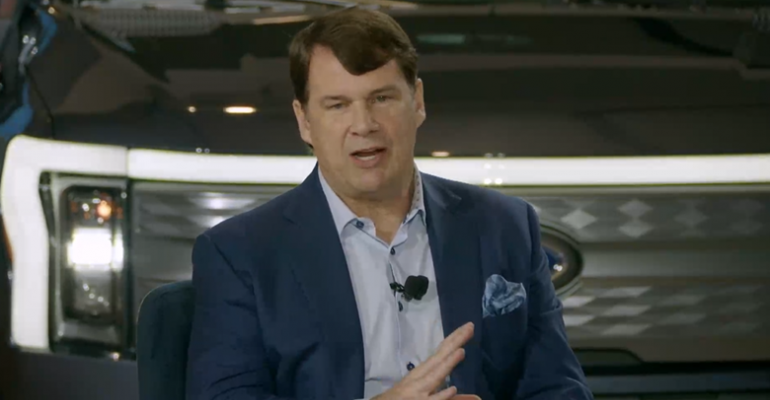

In announcing the move today, Ford CEO Jim Farley says there are no plans to spin off any of the operations into separate businesses with their own capital structures. However, Ford will issue individual profit and loss results so investors will have transparency in terms of how each leg of the company is performing.

“We certainly looked at spinoffs,” Farley says. “But No.1, we have enough capital; we can fund this ourselves. No.2, the magic in this is to focus both organizations on what they need to focus on, (not) asking everyone to do everything like we do today…and to get that leveraged between both organizations. If we spin this out – both entities or all three – we really risk that leverage.

“The new startups would love to have the industrial know-how of our company,” he adds. “Why would we spin out Model e and risk that? The same thing goes for the technology opportunities for our ICE business. Why would we spin that out? It doesn’t make sense.”

The reorganization will impact Ford’s dealers, who will be asked to specialize around each of the channels. Those selling BEVs will be required to operate differently, Farley says, suggesting they’ll carry little or no inventory, for example.

But unlike some startups, Ford is not looking to entirely bypass the retail network, which Farley believes ultimately will be an advantage over some startups when it comes to servicing and repairing vehicles and better communicating with customers.

“We’re going to bet on the dealer franchise system. That’s a different bet than I hear from others. But we’re going to do it by asking them to specialize,” Farley says, with some dealers being Ford Pro retailers, others focused exclusively on selling BEVs or more conventional ICE vehicles.

Farley says discussions this week with Ford’s dealer council suggests “they are pumped and ready to go.” He also says Model e executives will be more involved with retailers in the future, suggesting they’ll spend time interacting with customers on the showroom floor, adding, “We’re going to create a new experience that’s better than Tesla’s.”

Ford executives say the rejiggering of the company organization will allow Ford Blue and Ford Pro to focus on revenue generation to help fund BEV and technology development at Ford Model e, which in turn will concentrate on innovation that will support products throughout the company.

Cost cutting also is on the agenda. Ford Blue will be looking to take $3 billion in annual spending out of the system as it aims for a 10% profit margin by 2026, a 270-basis-point increase from 2021. The automaker is not specifying where that savings will come, but says cuts will be throughout the organization, from warranty costs and advertising to industrial outlays.

“Nothing is off the table,” says Kumar Galhotra, named president of Ford Blue. “(This will be) a major attack on structural costs.”

That likely includes a reduction in staff as well. But while no targets were set today, Farley promises transparency on whatever moves are made. “There won’t be any surprises,” he says.

As part of the announcement today, Farley says Ford will invest $50 billion in electrification and other advanced technology by 2026, when it is targeting BEV production of 2 million units annually, meaning about a third of its volume will be BEVs. That number will continue to grow, to about half of its total vehicle production in 2030, Ford says.

Part of that $50 billion in investment will go toward securing a supply line for key BEV components, such as batteries and the raw materials needed to make them, Ford says. It currently is working with the supply chain, including the mining industry, to make sure the automaker has what’s required to fuel its BEV targets.

“To be clear, this is going to cost billions in capital to ensure that capacity,” Farley says. “This is a very, very critical area for us. We recognize those companies that move on the supply chain faster than others will be part of the winners. We will be part of that.”

The reorganization signals the beginning of a shrinking ICE business for Ford, Farley acknowledges. But he says not all products are conducive to a conversion to electrification and there is still a long life left for ICEs in some segments.

“Yes, maybe over time, as the mass adoption of these digital electric vehicles accelerates, will our ICE volumes deteriorate? I guess that could happen,” he says. “But one thing people need to understand, a lot of our ICE products, those segments, are not served well by electric vehicles. If you have a Super Duty and you’re pulling a horse trailer, an electric vehicle isn’t an ideal solution.”

Farley says the moves announced today will better position Ford to face the competition coming from all directions.

“Bottom line, we have the opportunity to blow people away with new products,” he says. “Is this about winning? One hundred percent. We want to beat the old players; we want to beat the new players.”

Farley will take on the role of president of Ford Model e alongside his duties as Ford CEO. In addition to naming Galhotra Ford Blue president, here are other key executive moves in the reorganization:

- Doug Field, an ex-Apple executive hired by Ford last fall, becomes chief EV and digital systems officer for Ford Model e.

- Marin Gjaja is named Model e’s chief customer officer, heading the division’s go-to-market, customer experience and new business initiatives.

- Stuart Rowley becomes chief transformation and quality officer.

- Hau Thai-Tang will take the role of chief industrial platform officer, leading product development, supply chain and manufacturing engineering for ICE products and systems common across the company.