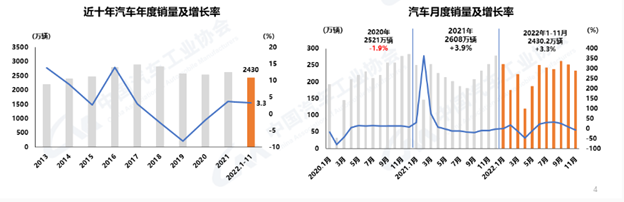

A new report from China’s Association of Automobile Manufacturers (CAAM) describes the impact of the COVID-19 virus, and the policy to prevent the spread of the virus, on China’s automotive sector. The report makes the point that the auto market is in danger from slowing demand and production disruptions.

Indeed, production and sales were lower than expected in November with sales continuing a monthly decline since August (chart on right). Production was down 8.2% and sales were off 7.1% since October. Annual figures also were slightly lower from November of last year (chart on left)

(Source: CAAM)

CAAM describes growth in the auto industry as “slowing down” and demand as “sluggish” with the entire industry under pressure from weakened consumer demand that has yet to regain its momentum after COVID.

The report says China’s auto industry is in a “critical window of transformation” and views “the stability and health of the consumer market (as) crucial to promoting high-quality development of the industry.” CAAM also reports gasoline- and diesel-fueled vehicles (ICE) are still quite necessary for the economy. The report even goes as far as to recommend policy intervention next year to encourage sales of ICE vehicles.

“We suggest that the auto market still needs continuous policy promotion, including the suggestion that the preferential tax policy for the purchase of traditional fuel vehicles in 2023 and relevant local consumption promotion policies can continue to dig deeper and further release the potential of auto consumption, drive industrial development and boost the economy (to) run smoothly,” the report states.

The report goes on to describe policies that would have been helpful but were undone by the country’s zero-COVID policy (the report blames the virus, but it’s the draconian response to the virus causing the economic damage). “The policy of halving the purchase tax this year to promote consumption has played an obvious role in stabilizing the growth of the auto market, but the epidemic in the second half of the year has affected the implementation effect of the policy.”

While the country saw production and sales of light vehicles across all propulsion systems (ICE and electric) rise almost 15% and 12%, respectively, from a year ago, the cumulative growth rate is slowing.

And despite month-to-month sales rising, even new-energy vehicles (NEVs) – those are any vehicle that use electrified powertrains, including battery (BEV) and fuel-cell electric (FCEV), as well as plug-in (PHEV) and non-plug-in hybrids (HEV) – are growing slower (blue line in chart).

Monthly Sales (Bars) & Growth Rate (Line) of NEVs in China

(Source: CAAM)

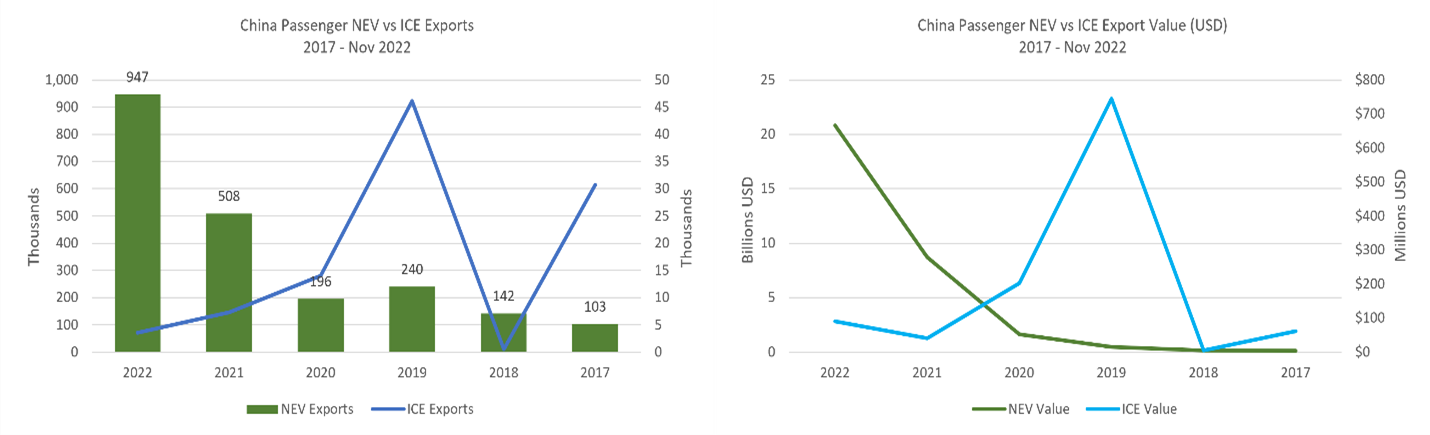

Chinese NEV makers may have anticipated the slowdown, because they have been pushing beyond China’s borders for several years. And the latest data from China’s General Administration of Customs (GAC) shows those efforts are paying off.

NEV exports grew 86% in the first 12 months of this year compared to all of last year with the upward trend rapidly accelerating since 2020. In fact, Chinese automakers exported more NEVs in the first 11 months of 2022 than during 2017, 2018, 2019 and 2020, combined, according to GAC data. The vehicles for the most part are going to two major regions; Europe via Belgium, the U.K. and Spain, and Asia Pacific via Australia, Philippines and Thailand.

(Source: Wards Intelligence/China General Administration of Customs)

What’s Next in China

With NEV exports soaring, China’s auto industry is becoming more self-sufficient across all vehicle types and drivetrains. From January through November the country imported 13% fewer vehicles compared with last year and 36% fewer compared with 2017.

Despite slowing growth at home, CAAM data highlights the luxury-vehicle sector as a growth area in the domestic economy. The segment is still quite small but grew almost 13% from January to November compared to the same period last year. And at least one company, BYD, intends to capitalize on the trend. The company will introduce a new luxury electric SUV, Yangwang, sometime in Q1 next year with a price tag between ¥800,000 to ¥1.5 million ($115,000-$216,000 ).

Chinese President Xi Jinping has been quietly relaxing the country’s zero-COVID policy since November. The disease is now rapidly moving through the population. The latest Omicron variants are extremely transmissible even if less deadly to adults under 50. But in China fewer than 60% of people in their 60s are fully vaccinated, and only about 20% of people in their 80s, according to Bloomberg News.

Wards Intelligence expects automotive sales to grow (even if at a slower pace) over the next five years but warns “the positive impact of removing COVID restrictions and opening borders could be overwhelmed by the potential negatives of increased COVID-19 cases, such as voluntary lockdowns, factory/port shutdowns and the further lowering of already diminished consumer confidence.”