Today’s higher new- and used-vehicle prices reflect the shift in consumer preference to trucks, especially fullsize pickups, and not just the short-term supply-and-demand situation alone, according to the latest quarterly report on retail auto finance from Experian Automotive.

“What consumers choose to finance has steadily changed over the years, with larger, more expensive vehicles like SUVs and crossover vehicles comprising a larger share of financing,” says Melinda Zabritski, Experian’s senior director of automotive financial solutions.

“When I look at the data for Q2 and somewhat into early Q3, there’s a return to earlier trend lines we saw pre-pandemic,” Zabritski (pictured below, left) says in a phone interview. “It seems we’re normalizing, somewhat.”

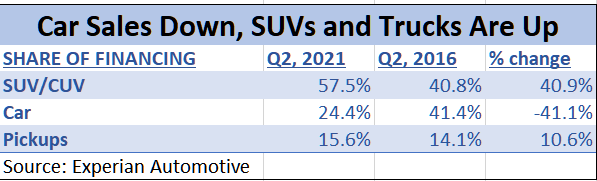

The State of the Automotive Finance Market report for the second quarter of 2021, published Aug. 19, illustrates the point about truck share, by comparing a few recent auto finance statistics vs. the same quarter five years ago.

Experian says SUVs, crossovers and pickups combined account for 73.1% of U.S. retail auto financing in the second quarter of 2021, vs. 54.9% in 2016. Car share in 2021 was just 24.4% for the quarter, down from 41.4% five years ago.

Over the same time span, the average amount financed on a pickup was $39,995 in the second quarter of 2021. That’s an increase of 20.5% vs. five years ago. For the average car, the average amount financed was $24,731 in the quarter, up 16.8%. So, it’s no wonder the average amount financed has increased, as truck mix has increased.

Some of the comparisons in the report were skewed by the fact that the second quarter of 2020 was the low point for auto sales and finance, during the early part of the coronavirus pandemic. At the time, North American auto factories were closed for weeks, and dealership showrooms representing a majority of U.S. sales volume were closed, with operations restricted to service and parts, and online sales.

With all that going on, the new-vehicle share of total auto financing fell to 38.1% in the second quarter of 2020. In the second quarter of 2021, new-vehicle share of all financing was 44.8%. That’s more of a return to normal, and not a significant increase, Experian says.

Another anomaly in the second quarter is that while prices are generally perceived to be up, the average new-vehicle loan amount for the second quarter of 2021 actually declined vs. a year ago, to $35,163. That’s down almost $1,000, or about 2.7%, from a record high a year earlier.

Actually, the anomaly is the year-ago numbers, Zabritski says. That’s because generous incentives on fullsize pickups a year ago caused a spike in those sales, and that helped lift the average loan amount for the whole industry, she says.

There was a slight increase in the average new-vehicle monthly loan payment, to $575 in the second quarter of 2021, vs. $570 a year ago. That’s an increase of only about 0.9%.

There was a slight increase in the average new-vehicle monthly loan payment, to $575 in the second quarter of 2021, vs. $570 a year ago. That’s an increase of only about 0.9%.

The average monthly payment increased, even though the average amount financed decreased, because the benefit of a smaller amount financed is offset by a slightly shorter average term, and a very slight increase in the average interest rate, Experian says.

For used vehicle loans, the average amount financed increased 9.4% vs. a year ago, to $23,365 in the second quarter of 2021. The average used-vehicle monthly loan payment was $430, up 8.3% vs. $397 a year ago, the report says.