The nation’s six biggest publicly traded, franchised dealer groups report higher parts and service revenue for the third quarter vs. the same quarter a year ago. The companies say customers are getting service work done that was put off due to the coronavirus pandemic.

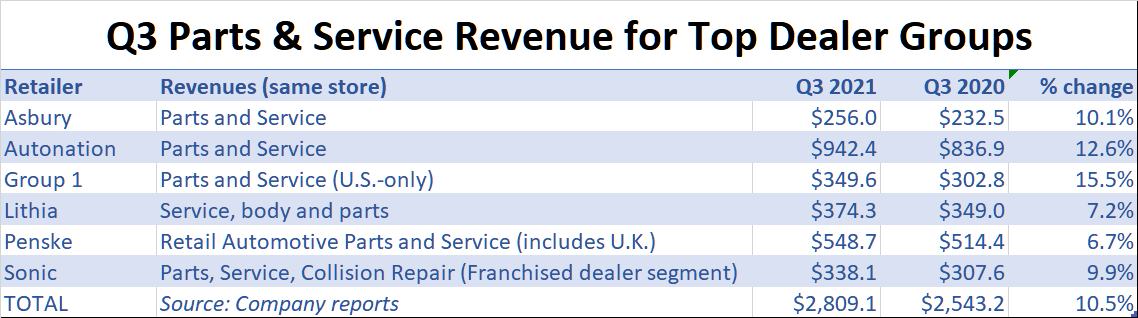

As a group (see info graphic below), the six dealer groups combined report parts and service revenue was about $2.8 billion, up 10.5% in the third quarter vs. a year ago. That’s on a same-store basis.

For Sonic Automotive, for instance, same-store revenue for its franchised dealership segment Parts, Service and Collision Repair category increased to $338.1 million, a 9.9% increase vs. the year-ago quarter.

“More than anything, there’s been some pickup in customer-pay, because people have been getting out more,” David Smith, CEO of Sonic Automotive, Charlotte, NC, says in an Oct. 28 phone interview. “Due to COVID, perhaps some people were postponing service they needed to have.”

Separately, Penske Automotive Group, Bloomfield Hills, MI, says much the same thing in its quarterly report to the Securities and Exchange Commission.

“We believe the same-store increase in service and parts revenue is related to the lifting of many COVID-19 restrictions, resulting in increases in vehicle miles traveled when compared to the third quarter of 2020,” the company says.

According to the latest monthly Vehicle Miles Traveled report from the Federal Highway Admin., travel on all U.S. roads was an estimated 273.8 billion miles in August 2021, an 8.3% increase vs. the year-ago month.

The dealer groups say in third-quarter reports that customer-pay work is on the rebound, but demand for other categories of service work, such as warranty and collision repair, has been slower to recover.

Jeff Dyke, president of Sonic Automotive, says in an earnings conference call Oct. 28 that within Sonic’s total service business, customer-pay work for the quarter was up 21%, but warranty work was down about 9% year-over-year. That echoes a trend at several of Sonic’s competitors.

Meanwhile, an ongoing shift to digital tools for communications, and for organizing dealership workflow, is also helping boost business in service and parts, dealer groups say.

Digital success stories include a big increase in customers scheduling their own service appointments online; the use of text messages for two-way communications with customers, if that’s what they prefer; and the ability to text customers video evidence of work that needs to be done, based on a multi-point inspection.

Dan Clara, senior vice president-operations for Asbury Automotive Group, Duluth, GA, says in a conference call that Asbury booked a record number of more than 143,000 online service appointments in the third quarter, a 12% increase vs. the third quarter of 2020.