Good habits are formed in bad times, and looking back, the dealer business upside to this year’s tragic COVID-19 pandemic should be a lot of good habits, born out of necessity.

Here are some examples, according to numerous phone interviews, industry conference calls and webinars throughout 2020:

- No.1 is the transition to a better online customer experience that doesn’t require a visit to the dealership for shopping, sales, financing or service – which also has to work seamlessly when customers switch back and forth between online and in-person.

- In turn, remote service makes pickup and delivery another lasting takeaway from COVID-19 and, for many dealerships, remote delivery for light service work. A higher degree of cleanliness is another offshoot.

- A lower cost structure is a painful but prudent habit, with lower dealership inventory, less traditional advertising and leaner dealership staffs – except for service technicians, who remain in short supply.

The pandemic is a catalyst for these changes, not a root cause. All these things already were good ideas: difficult to achieve, but possible before COVID-19. Especially in the case of digital selling, some of these ideas had been in the works for years.

California is the trend-setter. In a dramatic response to the coronavirus, Gov. Gavin Newsom issued a stay-at-home order for the entire state on March 19. Dealership sales and service could continue in California, but sales were online only, a restriction which remained in effect until May.

More states quickly followed. By April 5, just over two weeks later, 26 states had differing degrees of stay-at-home orders. That meant states representing 56% of U.S. new-vehicle sales in 2019 allowed online or remote sales only, according to J.D. Power. Another 24 states allowed showrooms to remain open.

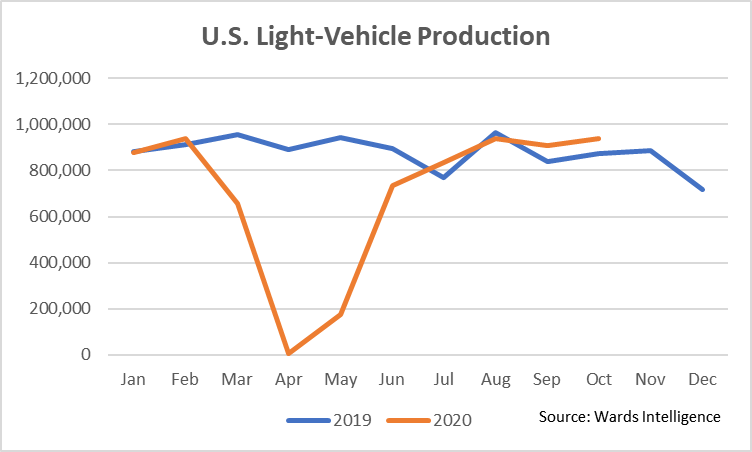

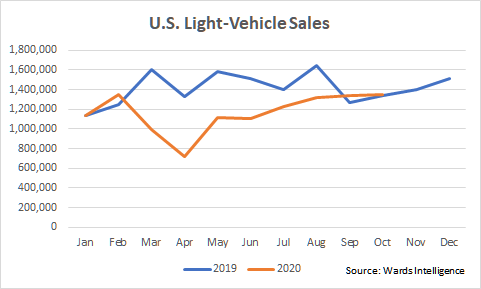

The pandemic also brought auto plants to a grinding halt. Auto sales and production bottomed out in April, but it’s less well-remembered that even in March, U.S. light-vehicle sales fell 38% vs. year-ago. U.S. light-vehicle production also fell 31% in March, according to Wards Intelligence.

In April, sales were down 46%. But production dropped 99% to fewer than 6,000 units. May sales fell “only” 29%, but production still was off 81%. Plants started rolling again in May, but it took until July before monthly U.S. production reached prior-year levels, a long stretch from when production began plummeting in March.

Sudden Impact on Showrooms

U.S. auto sales were doing OK until the bottom fell out. “Sales were up, everything was going swimmingly until March 11,” Tyson Jominy, J.D. Power vice president-data & analytics, says during an August webinar sponsored by the Wall Street Journal.

“That’s the day Tom Hanks announced he had coronavirus, and everybody thought, ‘If he can get it, anyone can get it,’” Jominy says. The week of March 8, U.S. retail auto sales were down just 1% vs. J.D. Power’s earlier sales forecast; the week of March 15, down 15%; the week of March 22, down 35%.

Nearly overnight, for most of the nation’s dealerships, business shutdowns made online sales need-to-have, rather than nice-to-have. And with plants closed, that meant dealerships only had existing new-vehicle inventory to sell.

Some dealerships embarked on a crash course in online sales, while some big retail groups, such as Lithia Motors in Medford, OR, already were well into behind-the-scenes work on their online sales channels. Lithia named its online platform Driveway last summer.

“We began to build out Driveway almost two years ago,” Lithia CEO Bryan DeBoer says in an October phone interview. “We spent tens of millions of dollars to be able to go to market a couple of weeks ago.”

There’s a lot more to Driveway than just online new-car sales, or just home pickup and delivery, DeBoer says. “The entire ownership experience is not just purchasing at home. It’s being able to buy, service, do all the things you do in the entire ownership experience.”

Initially, Lithia is phasing in different aspects of the Driveway concept, starting with its home region in the Pacific Northwest.

Eventually, DeBoer says Lithia customers across the country will be able to shop for and buy new or used vehicles, sell their trade-in, get financing, buy F&I products, take delivery, schedule service, have their car picked up and delivered for service and get a loaner car, all online.

The advertising tagline Lithia uses to describe the service is “In Your Slippers,” meaning customers can do everything without ever leaving home. But not even DeBoer thinks all customers will want to go 100% online all the time, even when there’s no pandemic.

So far, purely online sales are minuscule. In an earnings conference call on Oct. 21, DeBoer says about 80% of Lithia customers use the digital sales channel “in some way” during the buying process. But so far, he estimates only about 1.5% of sales are approaching all-digital.

The significant part is that Driveway is designed so customers can switch from online to in-person whenever they like, without the dealership missing a beat or losing track of the customer’s latest status, he says.

Digital Approach Not for Everyone

Separately, AutoNation Chairman and CEO Mike Jackson says customer use of AutoNation’s digital sales channel took off in the pandemic. The rate of growth may slow down after the pandemic, he says, but he doesn’t expect the trend to reverse.

“I’m happy we made the investments, that we were fully prepared for that moment. We didn’t expect that moment, but there it was,” he says in a conference call in July. AutoNation is based in Fort Lauderdale, FL.

“I’m happy we made the investments, that we were fully prepared for that moment. We didn’t expect that moment, but there it was,” he says in a conference call in July. AutoNation is based in Fort Lauderdale, FL.

Dealers get it, says Rhett Ricart (pictured, left), 2020 chairman of the National Automobile Dealers Assn.

Post-crisis, 82% of dealer respondents to a member survey say they plan to continue offering “virtual/digital sales process”; 72%, home test drives/delivery; 65%, Fixed Operations home pickup/delivery.

The July 2020 survey got a whopping 11,045 dealer responses, Ricart says.

However, digital-only commerce “doesn’t work for every customer in every instance. That just isn’t true,” Ricart says in a Nov. 17 webinar hosted by the Detroit-based Automotive Press Assn.

“Many customers will still want to do what they have always done – come to the store at some point to complete the transaction, to feel, smell and see the inventory, to try the ergonomics,” he says.

As sales have recovered from the business shutdowns of March and April, many dealership groups report they are not rehiring everyone who got laid off in the spring.

For example, AutoNation CFO Joe Lower says that through the third quarter, AutoNation headcount is down about 15% compared with the beginning of 2020. He says in an October conference call that AutoNation has made up for it in efficiency gains, with help from improved digital capabilities.

In the early phase of the pandemic, Sonic Automotive in Charlotte, NC, placed approximately 1,700 employees on unpaid leave. Most of those are back, but not another 1,200 employees who were terminated, the company says in an SEC filing.

Lower personnel costs, lower floorplan expenses due to reduced inventory and less traditional advertising all contributed to record third-quarter profits for several publicly traded, new-vehicle groups.

Nobody wanted the pandemic, but higher profits are a habit dealers hope to retain.