Wards Intelligence surveyed dealers throughout the U.S. to chart retail automotive’s present health, electrification challenges and future opportunities. This is part of a series analyzing our survey results.

Manufacturers have made it clear that they expect dealers to move toward battery-electric vehicle sales and service. Excluding exotics, an estimated 260 BEV models are expected to be available by the end of 2030, according to Wards Intelligence/LMC Automotive.

That is in keeping with predictions by analysts at the Edison Electric Institute, an association representing all U.S. investor-owned electric companies. They estimate 26.4 million electric vehicles will make up the 259 million light-duty vehicles on U.S. roads in 2030.

But some automobile retailers who ask not to be named say the automakers’ switch from internal-combustion-engine vehicles to BEVs is too quick. Dealers tell Wards customers may be slower to embrace BEVs than automakers expect.

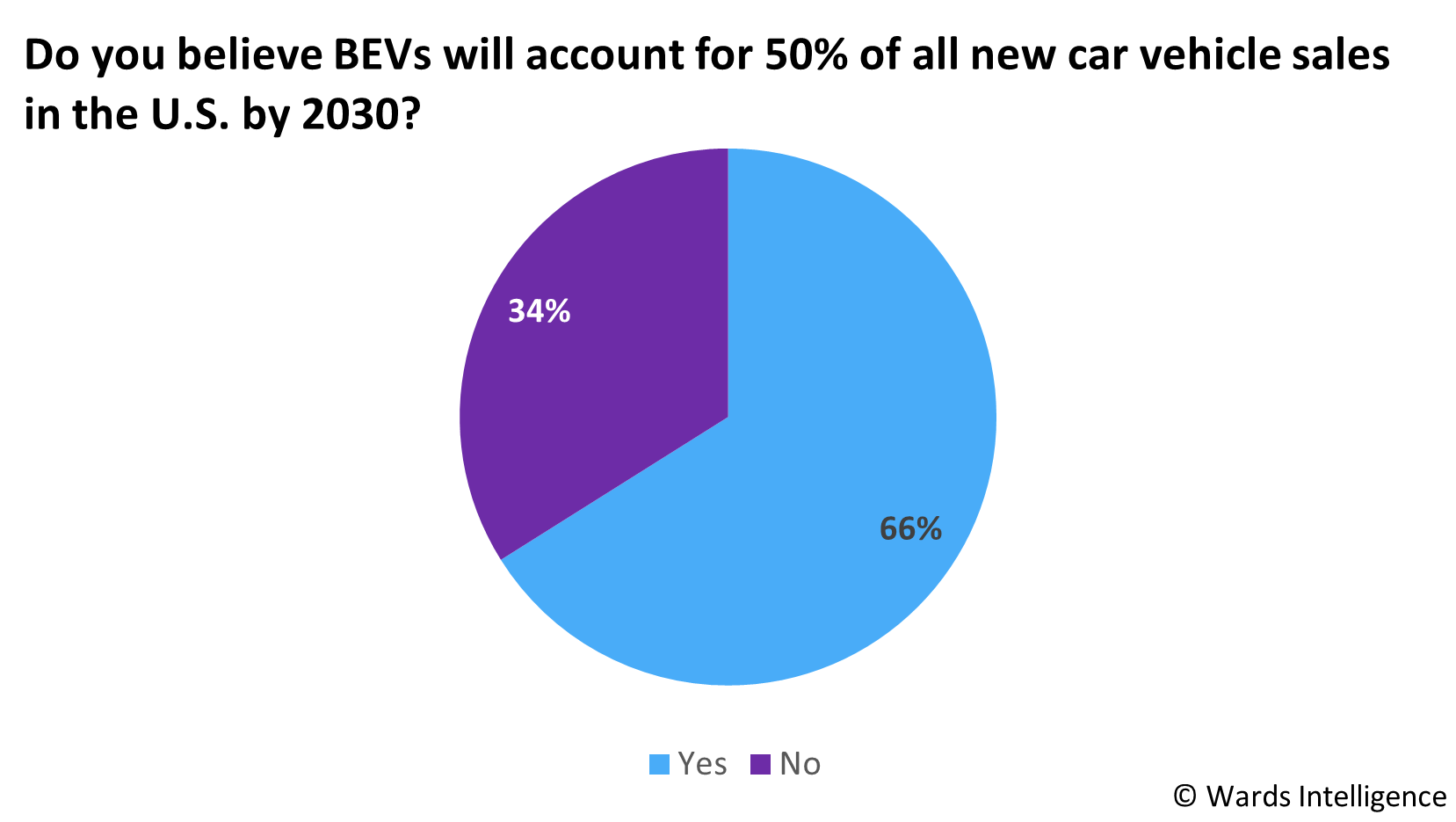

A Wards Intelligence survey of owners and employees at U.S. dealerships, conducted late last year, shows just over half of respondents (55%) believe BEVs will account for 50% of all new-car sales in the U.S. by 2030.

Of the total number of respondents, only 36% of owners or dealer principals believe the U.S. retail market will hit that goal. Yet 66% of sales managers do believe the goal will be met. The different viewpoints may result from the scarce new- and used-car inventory and high gas prices that prompted shoppers to talk about BEVs in the past year with salespeople.

A report by Pew Research Center shows about 9% of U.S. adults own battery-electric or hybrid vehicles. That’s up from the 7% reported in April 2021.

Several challenges stall BEV sales and adoptions. Shortages in parts – chiefly microchips – and raw materials slowed production, so some in-demand vehicles are in short supply.

That was underscored in mid-2022 when Volkswagen sold out of that year’s allotment of BEVs in the U.S. and Europe. Another example is Tesla. Customers who order those cars have historically had long waits – some reports say up to three years – though recent estimates are anywhere from one to seven months. A slowing in demand in some markets has certain brands offering incentives on various models, and Tesla and Ford have cut prices on some BEVs.

Although the chip shortage is easing, some insiders expect it to hamper production throughout 2023 and possibly into 2024. Others estimate the inventory shortage could last even longer for some manufacturers.

The price of BEVs, which J.D. Power estimates average about $10,000 above the cost of competitive ICE vehicles, keeps some shoppers out of the market. And the well-documented lack of charging infrastructure keeps even some monied buyers away from BEV models.

The Biden Admin. is working to alleviate the lack of charging stations through the National Electric Vehicle Infrastructure program that offers more than $900 million in funding to build EV chargers along 53,000 miles (85,295 km) of U.S. highways.

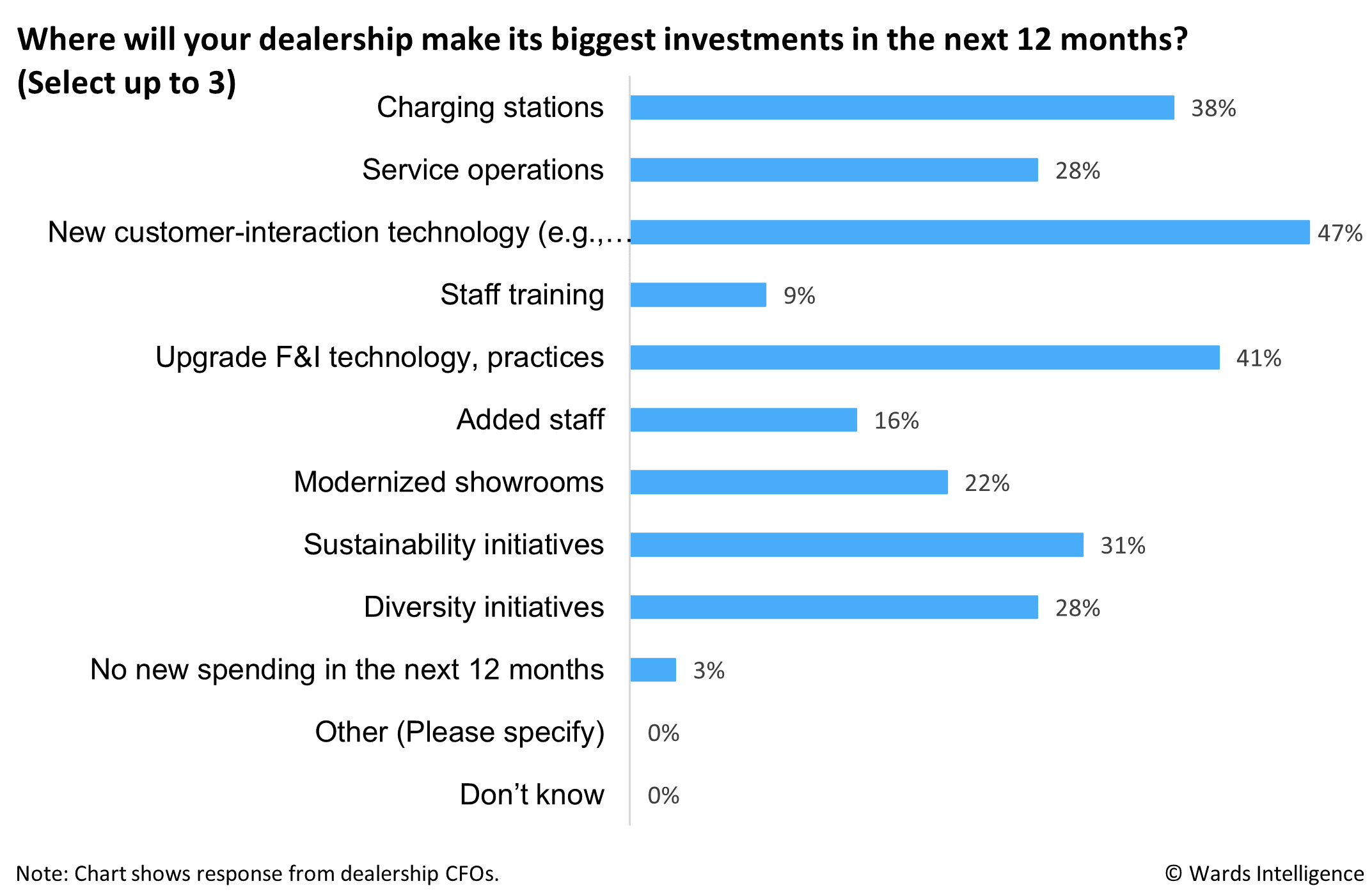

Survey respondents know customer concerns about the lack of charging stations and expect to add charging infrastructure at their dealerships to support their BEV sales efforts. The greatest number of survey respondents (35%) say charging stations will be among the most significant investments they will make in the next 12 months, followed by service operations.

Dealers and owners flipped the top two investments, with 34% saying service operation investments would be first and 30% ranking charging stations as second.

Other notable responses come from Fixed Ops respondents, who rank charging stations and service operation investments as almost equal (35% and 34%, respectively). That is nearly the same weight general managers and comptrollers gave those two categories (36% charging stations and 35% service operations).

Another challenge for dealers is hiring, retaining and training staff. Although survey respondents did not specifically mention BEV-related training and staff, industry insiders tell Wards there is a lack of both. CFO’s had somewhat different views as shown in the chart (pictured, below).

That’s problematic because some franchise dealers wishing to sell BEVs are expected to make hefty investments that will reduce dealership profits. As we previously reported, Ford originally required franchise dealers to invest between $500,000 and $1.2 million to meet the manufacturer’s requirements to sell and service BEVs. Prices fluctuate depending on various factors, including local and federal incentives. Ford also planned to limit the number of BEVs allocated to those not meeting the requirements.

Ford loosened the investment and other requirements. It also did away with the sales cap. Still, the manufacturer faces legal challenges about the legality of the program.

In a 2021 report, Chris Sutton, J.D. Power’s vice president of automotive retail, said: “BEV owners present a unique challenge for dealers. Not only are their vehicles more difficult to service than traditional internal-combustion-engine vehicles, but also the lower frequency of visits means dealers have fewer chances to make a positive impression on these customers.”

More recently, Power reports that “the next frontier is battery-electric-vehicle service experience,” noting dealers have “a significant satisfaction gap to close.”

Overall service satisfaction among BEV owners (784) is 68 points lower than among gas- or diesel-powered vehicle owners (852). Additionally, the average number of service visits a BEV owner makes in a year is 1.9 compared with 2.4 among gas- and diesel-powered vehicle owners.

BEV sales also impact F&I managers’ menus of extended-service agreements. F&I managers stress tires, brakes, suspensions, electrical systems and even struts and ball joints due to the excess weight BEVs carry, generally about 1,000 lb. (453 kg) more than a comparable ICE.

F&I managers ranked upgrading technology and practices as the second-largest investment they expect their dealerships to make in 2023. That comes just behind New Customer Interaction Technology (41%). The third greatest expense predicted by that group is charging stations (38%).

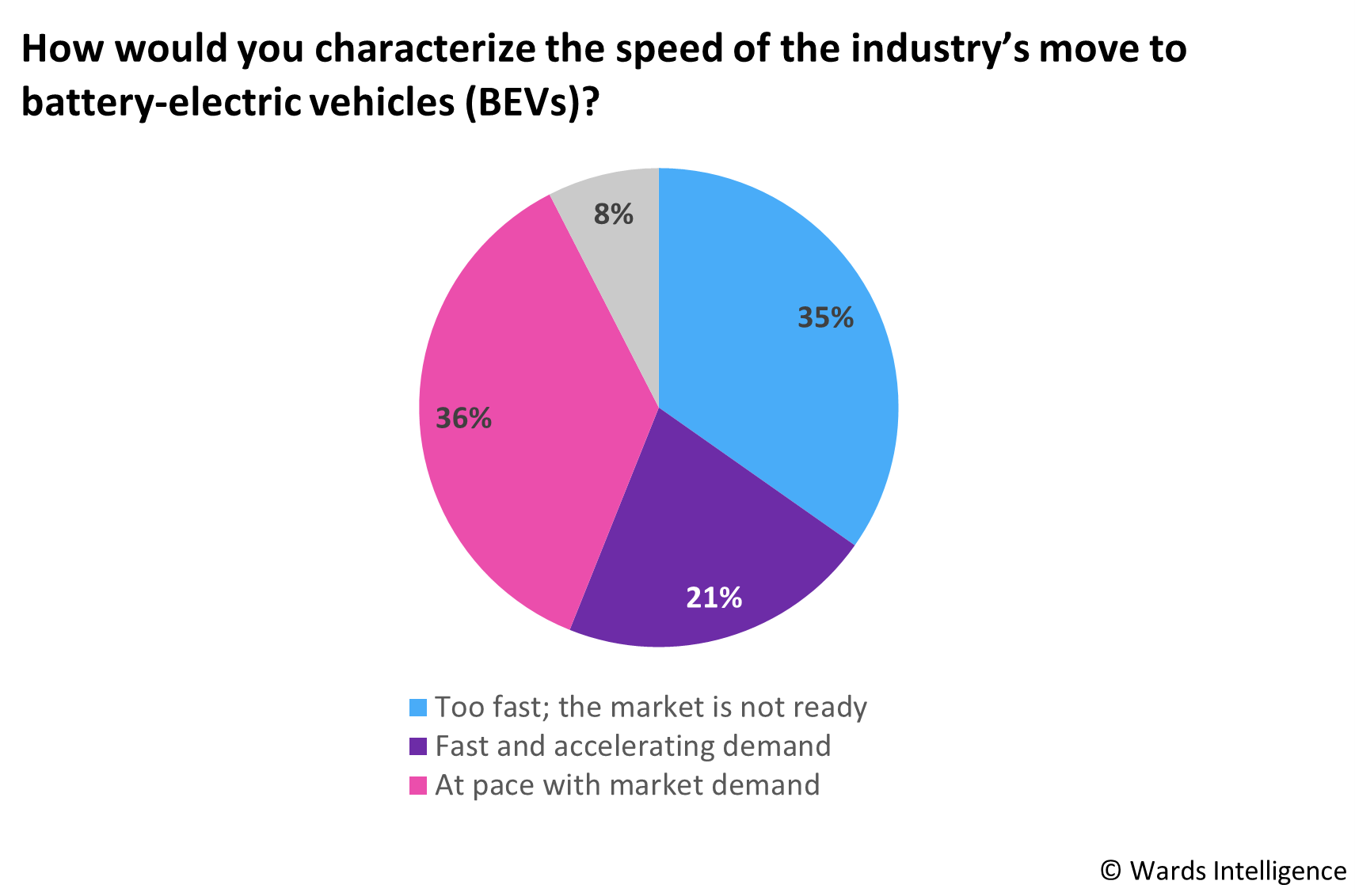

So, where do dealers stand on the adoption of BEVs? Some organizations, including the National Automobile Dealers Assn., report dealers are “all in.” Yet, dealers often grumble to Wards that the change from ICE to BEV is moving too quickly and outpacing customer demand.

Wards Intelligence survey results seem to reflect both views. Respondents are split among those who believe the industry is moving too quickly (35%) toward BEVs, and an almost equal number (36%) who say it’s on pace with market demand. Most other respondents (21%) indicate the pace is fast, keeping up with accelerating demand.

John F. Possumato, an attorney and founder/CEO of DriveItAway, a turnkey platform/consumer app that enables dealers to offer new mobility services, is among the industry insiders who believe dealers need to embrace the move toward BEVs.

Possumato, a former franchise dealer, recently wrote here that “between the OEM agency model, EV incentives in the federal Inflation Reduction Act and California phasing out internal-combustion-powered vehicles, it’s not hard to read the handwriting on the wall.” Beyond that, he notes U.S. financial institutions might stop financing ICE vehicles, as they have in Australia.

Although many dealers don’t want to comment on the record, outgoing Toyota CEO Akio Toyoda publicly says he counts himself in the auto industry’s “silent majority.”

“That silent majority is wondering whether EVs are really OK to have as a single option. But they think it’s the trend, so they can’t speak out loudly,” he says.

Toyota has fielded some criticism for not moving more quickly into BEVs, but Toyoda says: “EVs are just going to take longer to become mainstream than the media believes. In the meantime, you have many options for customers.”

Toyoda is not alone. Mazda and Nissan executives have offered similar concerns, though American automakers have more readily embraced the switchover. General Motors states it will produce only zero-emission vehicles by 2035. Ford will keep gas-powered vehicles in its lineup, though it committed $50 billion to electrify its offerings.