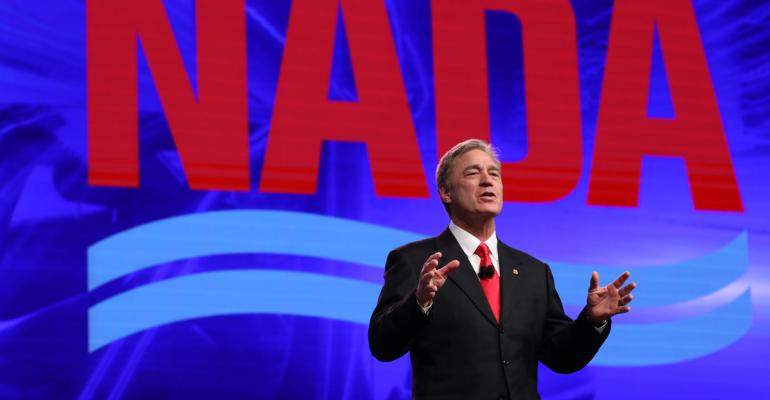

The COVID-19 pandemic puts new weight behind two longstanding complaints dealers have with OEMs, says Rhett Ricart, 2020 chairman of the National Automobile Dealers Assn. Automaker demands for expensive, lookalike facilities, which Ricart calls “mausoleums,” are the first dealer complaint. The second is retroactive, “stair-step” dealer incentives tied to hitting volume targets.

“Mausoleum mandates do nothing to help the dealers and the customers they serve,” Ricart says this week during a webinar hosted by the Detroit-based Automotive Press Assn. “If the OEMs think they’re so darn important, they ought to help the dealers with it.”

Ricart ties both complaints to the current social-distancing environment imposed by the coronavirus. The dealer association has complained for many years about OEM facility requirements – especially, the demand for uniform, corporate appearance.

Several OEMs put facility upgrades on hold during business shutdowns earlier this year. But NADA is on guard in case some OEMs dust off those plans, since sales have bounced back.

Such demands “didn’t do a damn thing to increase customer satisfaction before the pandemic,” Ricart says. In his view, they make even less sense during the pandemic, when many customers want to avoid the dealership completely.

There always will be some customers who want to come to the dealership to get questions answered, and to see, hear, feel and smell the cars and trucks for themselves, Ricart says.

However, he says the pandemic has sped up the evolution of the dealership showroom to “more of a delivery center,” where customers do most of the shopping and buying online and only come to the dealership to take possession – unless they opt for home delivery.

Under the circumstances, building a big showcase is out of touch with the new reality, Ricart says.

When a dealer builds a new building, “We’ve got to keep it, for 30, 40 years from now,” he says. “I think if you look around in 30 years, any building you have now is not going to look like a building you need, period.”

Compared with OEM facility demands, tying COVID-19 to NADA’s longstanding objection to stair-step incentives is a bit more of a stretch.

NADA’s basic argument remains the same, Ricart says: Retroactive, stair-step incentives distort the market, create customer distrust and hurt the brand image for both the dealership and the OEM.

Ricart doesn’t name any OEMs. Jared Allen, a spokesman for NADA, says separately Ricart was speaking in general terms about the entire industry.

What happens is, to earn the maximum dealer incentive per unit, say, for a whole month’s target volume for a certain vehicle, the dealership has to hit the target or else lose the per-unit bonus for the entire number, including the vehicles that are already sold. That’s the retroactive part. Dealerships that might miss the target are likely to drop prices at the end of the month.

“You come in one week and it’s one price, then you come in the next week and it’s not the same price,” Ricart says. “Nobody would like that on a big purchase, whether it’s a washer-dryer, or a hot tub, or anything.”

The tie-in with COVID-19 is that during the pandemic, more customers are switching to digital shopping, at advertised prices, Ricart says. “For the last eight months… digitization has made pricing so easy to understand,” he says. “If you advertise a price online, that’s pretty much your best price.”

That is, unless a stair-step incentive complicates pricing. “If we regress in this area, it is our customers that will suffer,” Ricart says.