The automotive industry is being disrupted.

Electrification is displacing weight reduction as the primary strategy for increasing the efficiency of vehicle fleets, and development of battery-electric vehicles is taking the lion’s share of resources devoted to all electrification efforts, including hybrid-electric vehicles and so-called mild-hybrid systems.

Even so, an increasing number of engineers and designers working at automakers and their suppliers say the industry can’t meet 2025 fuel-efficiency targets that were set in 2012. The Trump Admin. now is trying to ease them, but that process could be caught up in litigation for years.

The auto industry is developing enough EVs, hybrids and fuel-efficient cars to meet those original targets, but consumers are ignoring them and instead buying big pickup trucks, SUVs and crossovers, engineers say.

“I’m sure they could meet the targets, but it takes more than the automakers. It takes consumers to buy EVs. Until then, fat chance,” says one respondent to Wards annual survey of automotive engineers and designers.

Nearly two-thirds of the survey’s 429 respondents say the industry faces two major challenges in meeting the originally proposed 2025 standards: low consumer interest in small cars and electrified vehicles and increased costs with higher sticker prices. A third key challenge is the soaring popularity of less-efficient light trucks and crossovers that hurt overall fuel-economy numbers.

Through June, battery-electric vehicles accounted for just 1.5% of the 8.4 million light vehicles sold in the U.S. Of that total, 81% were Tesla luxury cars, while 19 BEVs shared the remaining 19%.

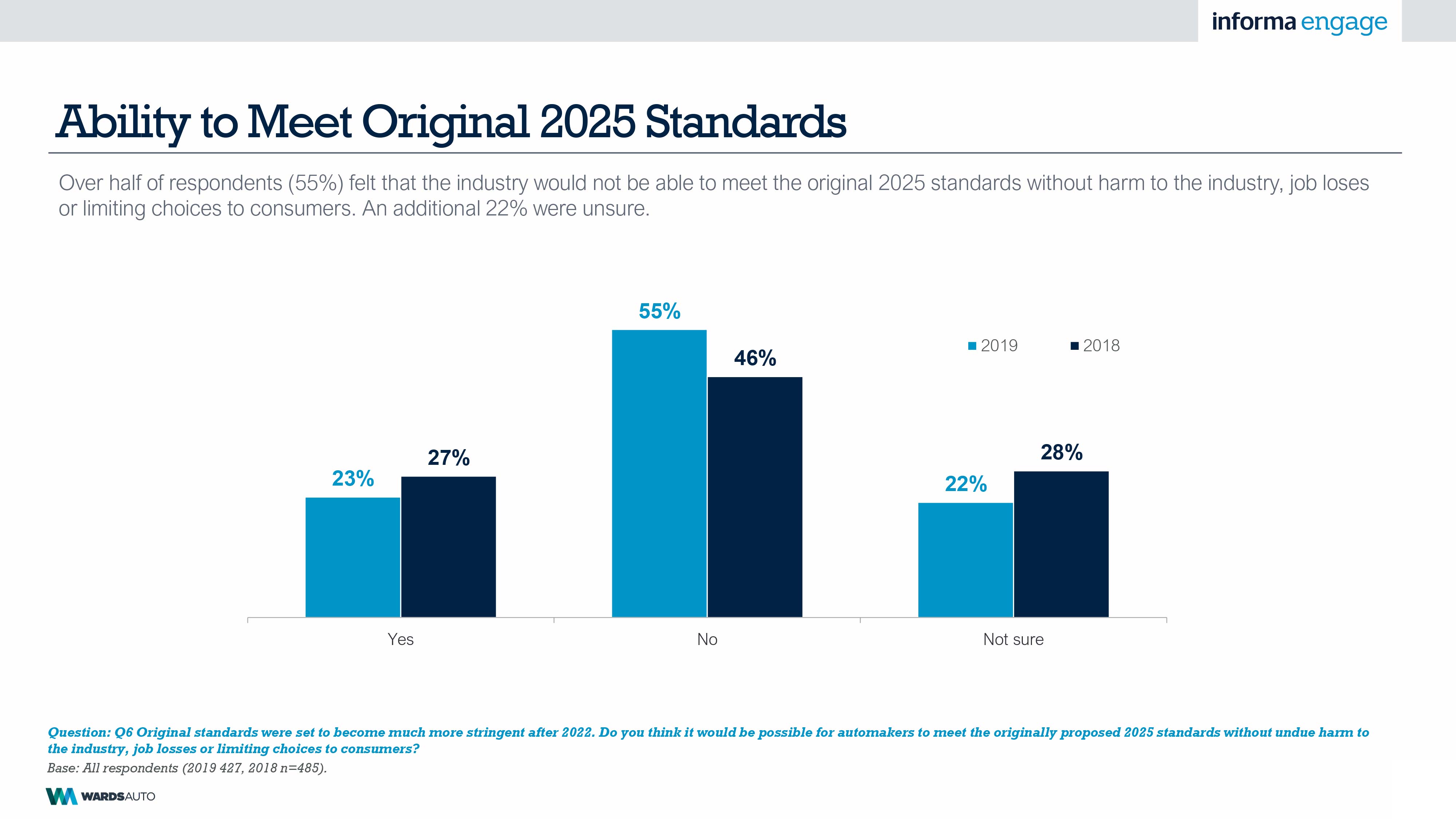

More than half of respondents (55%) say the industry would not be able to meet the original 2025 standards without harm to the industry, job losses or limiting choices to consumers. That’s an increase of nine percentage points over last year’s results.

More than half of respondents (55%) say the industry would not be able to meet the original 2025 standards without harm to the industry, job losses or limiting choices to consumers. That’s an increase of nine percentage points over last year’s results.

Still, many respondents point out the industry relies on global vehicle platforms and adhering to unified standards is the best way to save money.

“Just because we erase our standards doesn’t mean the rest of the world will erase theirs,” a respondent says. When selling vehicles outside the U.S., “automakers will still have to comply with standards established by other countries.”

Even though relaxed U.S. standards are on the horizon, the industry continues to increase EV efforts.

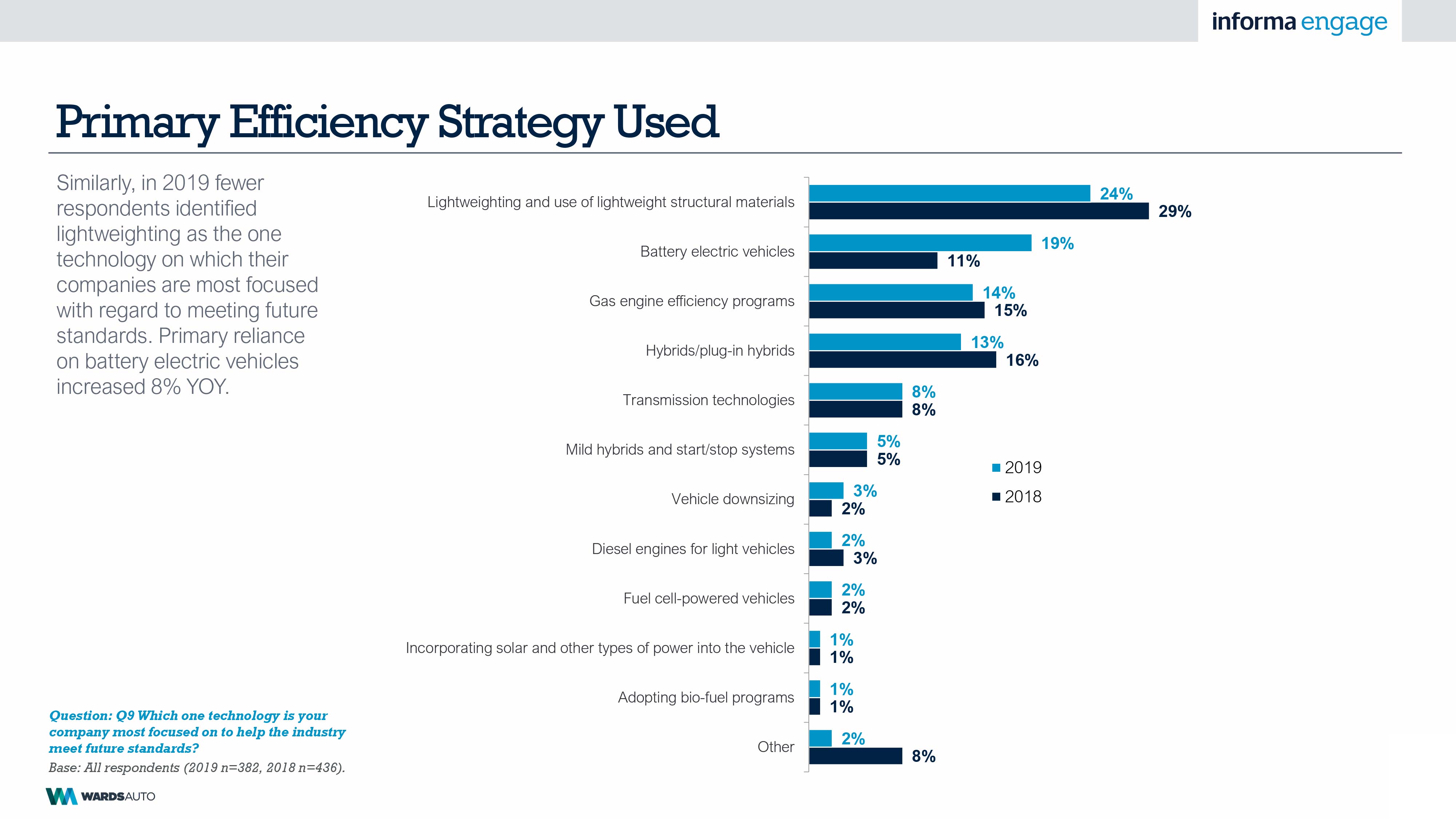

The Wards survey shows the emphasis on developing BEVs rapidly overtaking lightweighting as the one technology on which companies are most focused regarding future standards. Primary focus on BEVs increased 8% year-over-year while lightweighting lost considerable ground.

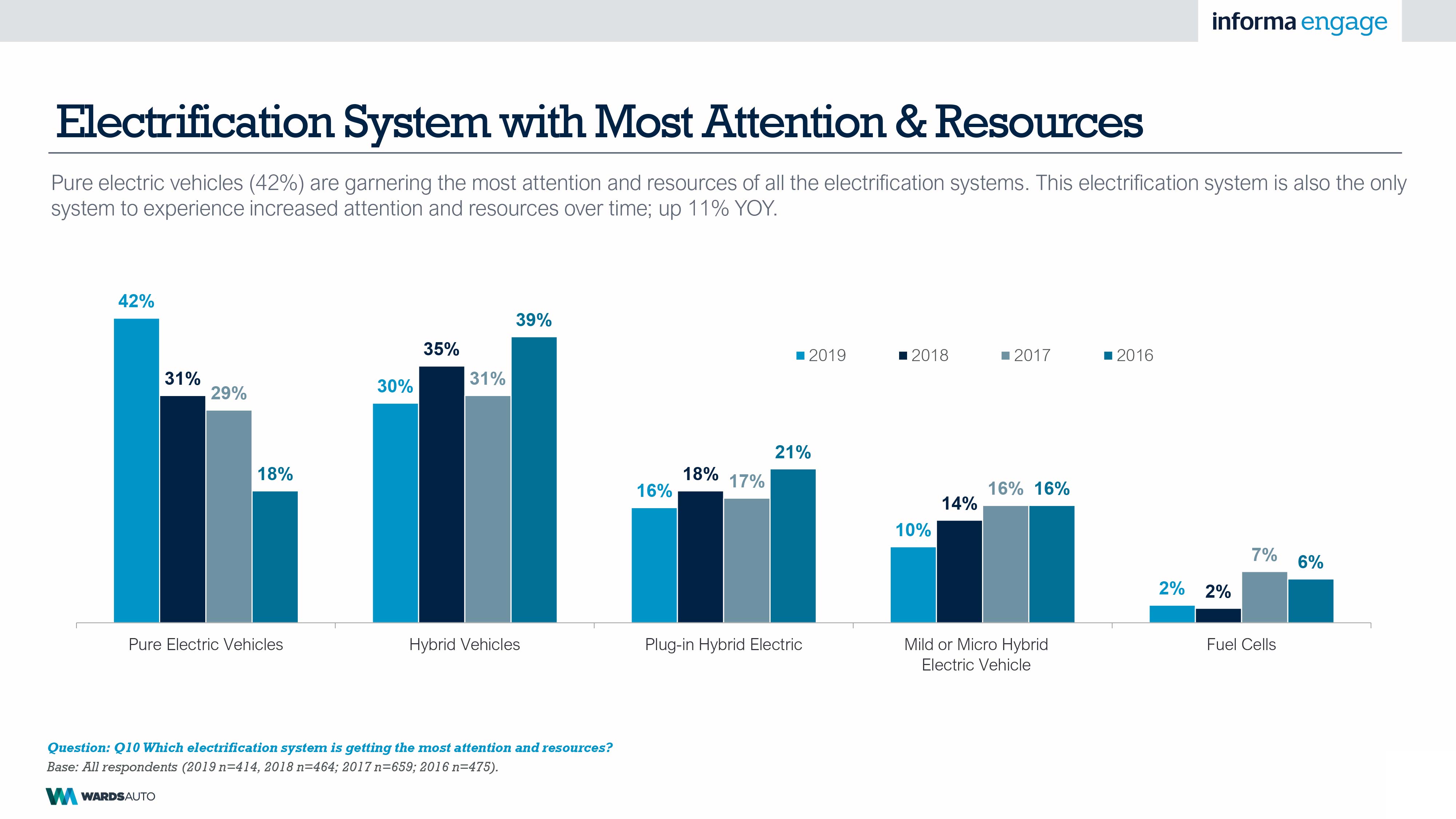

BEVs also are garnering the most attention and resources from all electrification choices, including hybrids, plug-in hybrids, mild hybrids and fuel cells, although not everyone agrees this is the best choice. “48V systems offer the greatest potential in the short term,” says one respondent.

Wards has been polling members of the automotive engineering and design community since 2011, asking about fuel economy, lightweighting and technology issues. The survey is sponsored by DuPont.

This year’s survey also showed that, in the trenches at least, the billions of dollars automakers are investing in autonomous-vehicle technology does not seem to be taking too much away from day-to-day research and development efforts.

The perceived negative impact of the push for autonomy was unchanged from 2018 after seeing an increase from 2017.

However, the negative impact of tariffs on the auto industry is very real. Most respondents report new tariffs have had at least some impact on their businesses (84%), most commonly price increases (55%), followed at a distance by an inability to pass along price increases (33%).

The regions where new tariffs would have the most negative impact is not a surprise: Mexico and China.

Meanwhile, aluminum remains the material most commonly relied upon in 2019 to reduce weight, but it lost a little ground from last year and now is followed more closely by multi-material solutions.

To achieve weight savings, 44% of companies are willing to pay $1 per pound or less while an additional 45% are willing to pay nothing to achieve weight savings. Most companies (83%) have remained unchanged in the amount they are willing to pay for weight savings.

“I have been in the auto industry 35 years,” grumbles one veteran. “It’s the same old story about lightweighting: No one will pay for it.” However, another engineer offers this fascinating insight: “It no longer is a question of taking weight out of structure. It is about getting more energy density into the battery.”

“I have been in the auto industry 35 years,” grumbles one veteran. “It’s the same old story about lightweighting: No one will pay for it.” However, another engineer offers this fascinating insight: “It no longer is a question of taking weight out of structure. It is about getting more energy density into the battery.”

Other highlights:

- One-third (34%) of respondents report their companies have increased investment in additive manufacturing in 2019. Half (51%) believe metals are the most important material to the future of additive manufacturing.

- Respondents continue to lack a high degree of confidence in the ability of today’s materials portfolio to help the auto industry meet CAFE standards: Just 20% are “very” or “extremely confident” in 2019, while 32% are only “minimally” or “not at all confident.”

- When asked about the issues causing their lack of confidence in the materials portfolio, respondents were by far most likely to indicate cost (76%), followed at a distance by supply reliability (39%).

- While most respondents (72%) report their use of structural adhesives and fastening systems has remained the same year-over-year, a fourth (26%) report increased usage. Virtually no one (1%) reported decreasing their use.

Survey Methodology: On June 26, Informa Engage emailed 39,621 WardsAuto subscribers with invitations to participate in an online survey. By July 18, Informa Engage received 429 completed surveys, for an effective response rate of 1.1%.