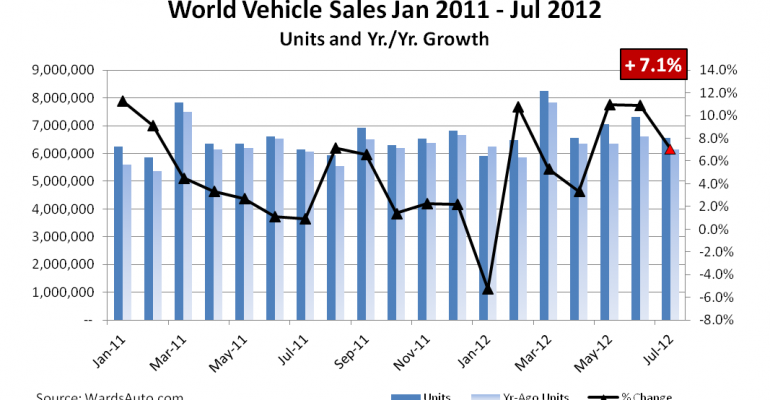

Global auto makers sold 6.56 million vehicles in July, lifting world vehicle sales 7.1% over same-month year-ago levels. It was the sixth consecutive month global deliveries outpaced prior-year sales.

Much of the year-over-year gain in recent months comes in comparison to a 2011 market impeded by short supplies and production disruptions caused by the Japan earthquake/tsunami in March 2011.

Asia/Pacific vehicle sales were up 14% over year-ago, to 2.8 million units, giving the region a 42.7% share of world vehicle sales, compared with last July’s 40.1% market share. Year-to-date sales in the region were up 12.1%, to 20.8 million.

Amid concerns that China’s overall economy is slowing, the world’s largest auto market accounted for 21% of all July sales, with 1.38 million deliveries, a 7.9% uptick over year-ago.

Japan sales were up 37.5% over depressed year-ago volumes, to 513,000 units, giving the world’s No.3 market a 7.8% share of sales compared with 6.1% last year. Thailand, meanwhile, recovering from market disruptions caused by extreme flooding last fall, recorded its highest volume ever. Government incentives for first-time buyers, new product entering the market and a concerted effort to meet pent-up demand combined to lift the nation’s vehicle sales more than 80% to nearly 132,000 units, about even with South Korea for the month.

In North America, auto sales also outperformed limited-inventory year-ago results with July volume rising 8.8%, giving the region a 21.5% share of global deliveries.

Auto makers sold 1.18 million vehicles in the U.S. in July, lifting sales 9.1% over like-2011, to give the world’s No.2 vehicle market an 18% share on its own. Sales in Mexico were up 11.7% to nearly 80,000 units, while Canada sales rose 5% over year-ago.

South American markets combined for more than 540,000 deliveries during the month, a 13.2% improvement over year-ago, accounting for 8.2% of world volume. Sales in Brazil jumped 19.1% over year-ago to a record high, fueled by another month of government tax breaks for new-car buyers.

Europe was the only region to record a year-over-year downturn, with deliveries falling 6.3% to 1.46 million. Against the backdrop of the ongoing European debt crisis, the region accounted for just 22.3% of world sales, compared with 25.5% year-ago.

Three of the top five European markets experienced downturns in July, including the region’s largest, Germany (-4.8%); France (-5.7%); and Italy, which saw deliveries plummet nearly 23%.

Smaller markets generally were down as well, though strong demand in Europe’s No.2 market, Russia (+12.6%), and the U.K. (+9.2%) helped offset some of the regional downturn. Indeed, Russia set an all-time record for July sales, coming within fewer than 9,000 units of displacing Germany as Europe’s largest auto market for the month.

World vehicle sales for the first seven months of 2012 came to 48.1 million units, a 6.1% year-on-year increase.