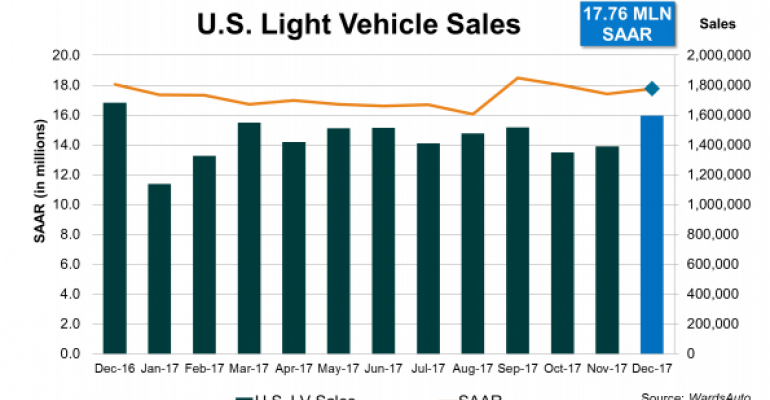

U.S. light-vehicle sales ended 2017 with a strong December on a seasonally adjusted basis, although results were below same-month 2016’s blowout totals.

December’s total also made 2017 the third straight year sales topped 17 million units, the first time in history that has happened.

December’s 17.8 million-unit SAAR was higher than November’s 17.4 million but below like-2016’s 18.1 million – a 15-year high for the month. Volume totaled 1.596 million units, equal to a daily selling rate over the month’s 26 selling days of 61,377, and 1.5% below December 2016’s DSR of 62,280 – 27 selling days.

Total LV sales in 2017 of 17.13 million units was 1.9% below the all-time high set in 2016 of 17.46 million, but only the fifth time sales topped 17 million. It also was the lowest since 16.45 million in 2014.

Trucks surged to 69% of the market in December with sales up 5.7%, based on DSR. For the year, truck sales totaled 11.06 million units and accounted for 64.5% of total demand – both were records.

Car deliveries declined 14.4% year-over-year in December and ended 2017 with total sales of 6.08 million units, or 35.5% of the market.

Incentives and fleet volume both helped boost volume in December.

Estimated fleet deliveries equaled 18.0% of total LV volume, up from 17.2% in same-month 2016.

The boost from incentives was less obvious. The estimated year-over-year increase in average incentive spending in December was small (2.3%), but only because of a comparison with a hefty year-ago spike of 23%. December’s average incentive level of $3,844 was the second highest for any month since WardsAuto began tracking ALG’s data seven years ago.

Among the Top 6 automakers, which account for roughly three-fourths of the market, only Ford and General Motors posted gains from December 2016. GM’s increases were centered in CUVs and Large Pickups. Ford’s increases were rooted in its Large Pickups and new SUVs.

Ford’s overall car deliveries declined slightly in December, but the Ford Fiesta, Focus and Mustang – though each still posted strong declines for the entire year - recorded increases last month.

FCA, Honda, Nissan and Toyota each recorded declines in sales and market share from December 2016.

Among the rest of the industry, most automakers selling a high mix of luxury vehicles did well in December.

Volkswagen Group’s Audi and Porsche brands notched December year-over-year increases of 20.8% and 1.2%, respectively. Also, BMW was up 7.6% and Daimler posted a 10.4% increase. Volvo’s sales were down 1.0% but market share increased over December 2016. Jaguar Land Rover, after a 2-year-plus ride of constant double-digit gains, notched its fourth loss in the past six months in December.

Additionally, Subaru and Mitsubishi also posted gains in December on the strength of their CUVs. After seven straight declines, Hyundai pulled off a 6.0% increase on the strength of its Genesis luxury cars, a surprise double-digit gain for the Hyundai Elantra and surges in deliveries of its CUVs.

Others posting declines, such as Kia and Mazda, tended to have car-heavy portfolios.