Automakers are planning a robust North American assembly pace in first-quarter 2014, as production schedules call for the completion of 4,237,400 cars and trucks.

That’s the fifth-best volume for the quarter in history, averaging 68,345 units on each of 62 regular work days, 2.2% more than the 66,903 cars and trucks assembled daily in like-2013, when there was an average of 61 work days.

It also comes to within 9.1% of matching the industry’s first-quarter output record of 4,811,021 units built in 2000, a daily average of 75,172 units.

Much of the growth in January-March vehicle production comes in Mexico, where record output of 814,400 cars and trucks marks the fifth consecutive annual gain. That’s a 4.3% jump to 13,351 daily from prior-year’s 12,799 units on volume of 755,136.

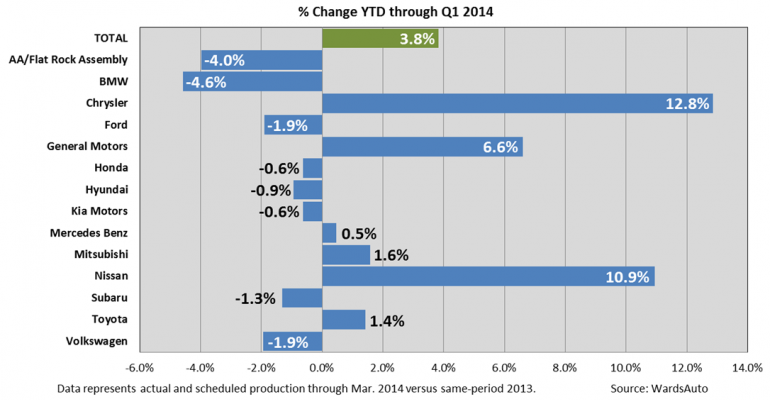

With 642,000 completions booked, Chrysler leads the industry with a 12.8% increase in January-March, up from 568,900 in Q1 2013.

That gain comes from a 20.3% hike in light-truck output that more than offsets a 4.0% decline in scheduled car production. Chrysler’s car-production decline is due largely to lower demand for its aging midsize models.

General Motors is planning a 6.6% first-quarter output boost, but unlike Chrysler, GM’s gain is the result of a 19.1% bump in car production, while light-truck output essentially remains flat with year-ago.

Ford, on the other hand, plans to build slightly fewer vehicles in the quarter, with its car slate down some 10,000 units and trucks off 4,000.

Among the transplants, Nissan, with 406,000 assemblies planned, is set build 10.9% more vehicles in January-March, compared with prior-year’s 366,000 units, closing the gap with rival Toyota’s 442,900 units to 8.3% in 2014 from 16.2% in 2013, when Toyota turned out 436,600 vehicles.

The strong first-quarter plan comes on the heels of a revised October-December slate calling for an estimated 4,129,600 cars and trucks, 5,600 higher than a month ago and 6.0% higher than prior-year’s 3,895,700 completions.

The revised figures includes a final October count 7,500 units higher than earlier estimated that, coupled with an estimated November overbuild of 1,500 vehicles, more than offsets a 3,100-unit cut in the December slate.