The average unadjusted fuel economy of U.S. light vehicles from 2014 needs to increase 57% to meet 2025 goals, according to the new WardsAuto CAFE Performance Index, based on EPA and NHTSA standards.

The annual rate of improvement will need to be about 4% to meet those 2025 goals. Small and midsize cars are closest to their requirements, while large cars and SUVs need the most development.

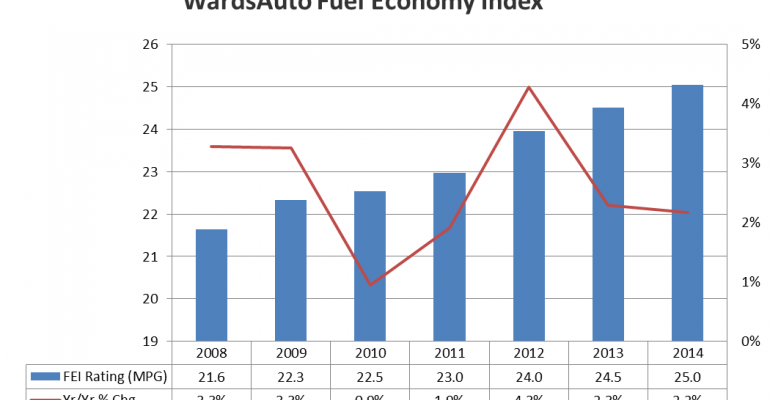

The WardsAuto Fuel Economy Index showed new light vehicles sold in the U.S. had an average window-sticker fuel-economy rating of 25.4 mpg (9.3 L/100 km) through the first-half of 2015, just 1.3% above like-2014. The results for calendar-year 2014, 25.0 mpg (9.4 L/100 km), were 2.2% higher than the prior year.

A sharp drop in the average price of gasoline moved some consumers to larger, less-efficient vehicle types, thus slowing the rate of progress. These trends started last year and continue to hinder growth for 2015.

Improvement in the index results was due to the increasing availability of more-efficient vehicles. While dealing with consumer demand for traditionally less-efficient cars and trucks, automakers are using smaller engines and higher-speed transmissions to reach CAFE standards. Four-cylinder engines powered 52.2% of U.S. LVs in model year ’14. Eight-speed automatics and CVTs have increased share at the expense of 4-, 5-, 6- and 7-speed units.

Light trucks accounted for 52.6% of indexed sales in 2014, above cars for the second consecutive year. The rating for cars improved 2.9% from 2013 to 29.2 mpg (8.1 L/100 km). Light trucks averaged 21.1 mpg (11.1 L/100 km), up 2.8%. All eight WardsAuto vehicle segments exceeded previous index highs in 2014.

Small cars scored 31.1 mpg (7.6 L/100 km), up 3.0% from prior-year. Midsize cars grew to 29.6 mpg (7.9 L/100 km) rating, but have shown significant drops in market share.

Large cars, at 21.9 mpg (10.7 L/100 km), are the lowest-rated segment, but also have the smallest market share. The score for luxury cars rose 7.6% to 25.6 mpg (9.2 L/100 km), scoring higher than the light-vehicle average for the first year.

CUVs comprised the largest market segment for the sixth consecutive year, 27.3% in 2014, and are the highest rated light-truck segment at 23.3 mpg (10.1 L/100 km), better than the average of large cars. The index rating for SUVs rose 2.3% to 18.1 mpg (13.0 L/100 km).

Vans recorded a 2.4% increase to 21.0 mpg (11.2 L/100 km). Light-duty pickups improved 2.4% to 17.2 mpg (13.7 L/100 km), but remained the lowest-rated segment on the index.

In 2014, the average cost of gasoline per 100 miles (161 km) driven dropped down to $14.38 after being above $15 in the three previous years. This decline in fuel costs was a primary factor in the share of traditional gasoline-powered models gaining favor over hybrid and diesel vehicles. However, plug-in hybrids and electric vehicles continued to show small but continuous growth in market share.

For more information, download the full WardsAuto Fuel Economy Index: State of the Industry 2015 report.