Galpin Ford in North Hills, CA, is considering converting a Mustang showroom into a display area highlighting alternative-fuel vehicles.

“We’d make it a place for customers to be educated about green cars,” such as the Ford Fusion Energi plug-in hybrid-electric vehicle, says Terry S. Miller, general sales manager at Galpin, the world’s largest Ford dealership, located in the San Fernando Valley.

“We use green as a marketing tool,” he says. “The market is taking off, at least in our area.”

But not everywhere, even though automakers are launching a growing number of models that are easier on the environment than traditional gasoline-powered cars. Touting the green aspect of these models as an advertising strategy might work for dealerships in a few select markets.

Hype aside, however, old-fashioned fuel economy at a reasonable cost still seems to matter most to many consumers.

“It is unlikely that green all by itself is going to make someone pick one car over another,” says Lincoln Merrihew, vice president-transportation at MillwardBrown Digital, a market-research firm.

He calls green marketing “a feel-good strategy.”

People choose a model based on lower operating costs, which generally includes good fuel economy, Merrihew says. If they can lower their fuel costs and feel good about the environment, they may choose an alternative-fuel vehicle.

But for dealers looking for an advertising strategy, “lead with the wallet, follow with the heart,” he advises.

J.D. Power data backs up that recommendation. In a 2013 customer survey, environmental impact ranked far down the list of purchase reasons a model was chosen, behind even cargo capacity.

Fuel economy was the top consideration for purchasing a non-premium model, the third most important reason for purchasing a premium model.

“The people who say (environmental impact is the top reason) are the people who buy zero-emission vehicles,” says Jon Osborn, auto research director at J.D. Power. “But even they emphasize gas mileage. (Green) is not resonating with people.”

The steady stream of price cuts for PHEVs, most recently the $4,620 drop in the price of the ’14 Toyota Prius plug-in, gives truth to that statement.

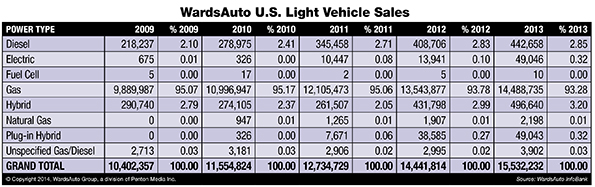

Sales of green models still remain a small part of the market. Plug-ins and EVs accounted for about 1% of the total U.S. light-vehicle market.

Even in California, the largest market in the U.S. for alternative-fuel vehicles, not all dealers are keen on green as a marketing message.

Peter Hoffman, president of Sierra Auto Group in Monrovia, CA, east of Los Angeles, doesn’t emphasize green in the advertising for his group, which includes Chevrolet, Honda, Acura, Chrysler, Jeep, Dodge, Ram, Fiat, Subaru and Mazda franchises.

People aren’t snapping up the natural gas-powered Civic CNG, which he considers the most environmentally friendly car he sells.

Incentives are why people buy PHEVs and EVs, Hoffman says. In California, models such as the Chevrolet Spark EV are eligible for thousands of dollars in subsidies, and buyers get access to the high-occupancy vehicle lane. “It is a heck of a deal,” Hoffman says. “That is what is driving the market.”

In the Midwest, the environmental messages matter little, says Jason Junge, owner of Junge Automotive Group in Cedar Rapids, IA. It includes Chrysler, Dodge, Ram, Jeep, Ford, Lincoln, Mazda and Volvo franchises.

The demand for plug-in electric models is low in the Midwest, he says. Sales of the Lincoln MKZ hybrid and Ford Fusion hybrid models have picked up in the last year or so, Junge says. But “the main selling point is the fuel economy.”

The story is the same at the Red McCombs Automotive Family in San Antonio, which includes Ford, Hyundai, Toyota and Scion franchises.

McCombs doesn’t emphasize green cars except to note they get good mileage, says dealer principal Marsha McCombs Shields.

“Fuel economy rules,” she says. “Of course, this is the truck capital of the U.S. But even those customers are looking at fuel economy.”

Here are some recently introduced and soon-to-be introduced alternative-fuel vehicles, with WardsAuto editors’ comments on their significance.

- Cadillac ELR: Not going to sell in volume, but it’s significant because its General Motors’ challenge to the media darling Tesla Model S.

- BMW i3: Compelling because of its relatively low price and BMW’s willingness to dip into mainstream territory. The interior is wonky, but the drive is first-rate.

- Ford C-Max: Started out strong, but is starting to fade. Fusion PHEV sales have been solid.

- Honda Accord PHEV: Has some unique technology: At highway cruising speeds, it slips into engine mode and, unlike the C-Max and Toyota Prius, decouples its electric powertrain, allowing the 2.0L engine to drive the front axle via a single lockup gear.

- Kia Soul EV: Pricing is not announced yet but if Kia can keep it under $30,000, as it has with all other Soul grades, the brand might have a hit on its hands.

- Chevrolet Spark EV: It’s a new intro. The Chevy Volt is the best-selling plug-in, even though it isn’t new.

- Infiniti Q50 PHEV: A fine-driving car with plenty of internal-combustion muscle.

Fiat 500E: With good reason, it’s a Ward’s 10 Best Engines winner. There’s no torque converter, so power delivery is instantaneous.